With GCredit now available to more and more GCash users, Filipinos now have an easy way to build their financial history.

“Isang kahig, isang tuka”, “One day millionaire, thirty days broke” – we’ve heard these sayings more often than not. We’ve heard it while we were growing up, and we’re hearing it now. Are we still going to live from paycheck to paycheck? Do we still have to sacrifice in order to get by until the next payday? This is the reality of a lot of Filipinos – those who have difficulty budgeting or have to look for ways to access that extra cash because of unforeseen expenses.

So how do we solve this problem? Mynt, a fintech startup owned by Globe Telecom, Ant Financial, and the Ayala Corporation has introduced the country to its first trust score-based lending from its lending arm, Fuse, which is GCredit and GScore.

GCredit is a revolving credit line that was first available on beta mode to GCash users who had a high enough GScore. GScore, on the other hand, is a trust score rating which is based on one’s relationship with GCash. It paints a more realistic picture of one’s financial behavior, showing the individual’s financial capacity to pay back credit based on their usage – the more one uses the app, the higher the score.

As your GScore relates directly to your GCredit, the way to make it really work for you is trust. So let’s build that trust by building our relationship with GCash –buying load, sending money, paying bills, and the like – one builds up one’s GScore. A more positive GScore reflects a positive financial history, and a good history leads you to a higher GCredit line.

With GCredit now off beta mode, it means that more GCash users can now have access to a credit line without having to show for a number of formal documents. All users have to do is use their GCash app more and more to increase their GScore.

GCredit is ideal for everyone, as this can be used for emergencies such as paying bills, buying groceries, and even purchasing medicines. With GCredit, we no longer have to patronize loan sharks who charge unreasonably high interest rates, or even worse, put purchasing important things such as food or paying bills on hold just to make ends meet.

GCredit has a maximum of 5% per 30 days of your used credit – for example, a credit limit of P1,000.00, maximum charges for 30 days is only P50.00 – making payments easier on the pocket, thanks to its prorated computation. Likewise, this enables one to pay earlier and in full–as the earlier you pay, the lower the interest rate will be, and the faster your credit limit is replenished.

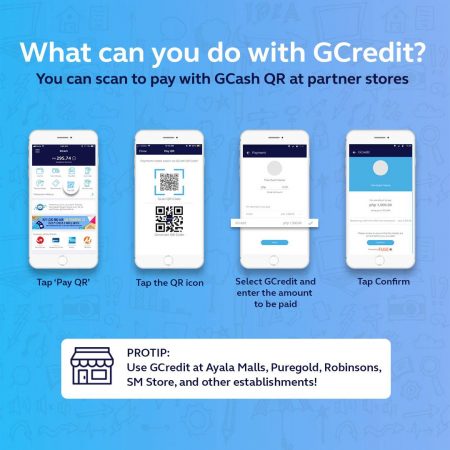

GCash users can use GCredit in its more than 20,000+ partner stores across the country via QR payments. It can also be used to pay the more than 270+ billers in the GCash app.

In a nutshell, the more responsible you are with payments – paying in full, paying on time or even earlier – the lower your interest rates, the higher your trust rating will be, which leads to a higher credit line, allowing you to face life’s challenges head on and enjoy milestones without worries.

With all that GCash and GCredit has to offer, being cashless has never been so rewarding.

GCash is available to download on the App Store and Google Play.