Nowadays I often find myself thinking of what the future holds for me. I live alone so you can just imagine how the silence of it all has got my brain working overtime, especially with all the uncertainties brought about by the COVID-19 pandemic. If there’s one thing this health crisis has taught me, it’s to not be complacent and to always be ready. Since I’m not getting any younger, you can bet my biggest concern is how I can keep myself in tip-top condition, so I don’t get sick and end up having to spend thousands on hospital bills!

Interestingly, I was recently introduced to Cash for Dengue Costs, a product of digital life insurer Singlife and e-wallet GCash that protects its policy holders from unforeseen medical costs due to mild to severe cases of dengue and—get this!—COVID-19. I admit, I was never a fan of health insurance or any kind of insurance for that matter since I find them too expensive to maintain, but this one’s different.

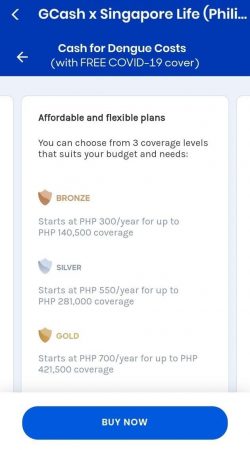

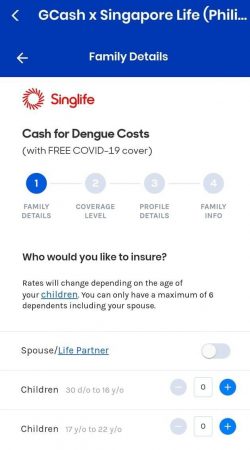

It has multi-level benefits which includes allowance for testing, confinement, and medical cost reimbursement for more serious cases. What’s also nice about it is that it can be customized to fit what I think I would need in the future and also what I can afford now. Plus, an option to cover only myself (Individual Plan) or to include my extended family (Family Plan).

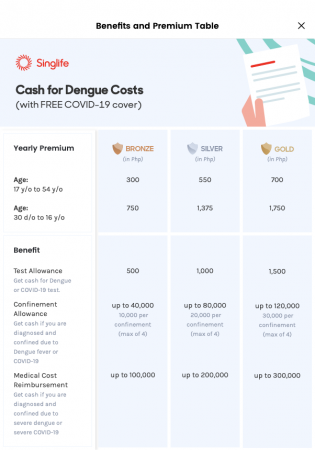

Here’s a comprehensive benefits table if you want to see the different premiums and coverage levels that come with this insurance product:

It’s true what I read about Cash for Dengue Costs – that it is both easy on the budget and generous on coverage. For as low as Php 700.00 per year, you can get coverage of up to Php 421,500.00. It also comes with a free COVID-19 rider BUT only for the first 10,000 customers. (You know what to do after this!)

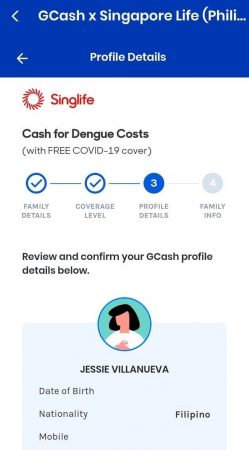

Applying for Cash for Dengue Costs will take you less than 5 minutes if you have stable internet connection. To purchase, all you need to do as a verified GCash user between 18 to 54 years old is to click on GInsure found on your GCash dashboard, click Cash for Dengue Costs, go through the very simple application process, pay the premium using your GCash wallet, and you’re done!

Since I’m not married, I chose the Gold coverage individual plan and it only cost me PhP 700.00! This is per year, by the way. Still, that’s pretty cheap considering the benefits. You also don’t have to worry about missing payment deadlines since GCash will automatically renew your Cash for Dengue Costs coverage and deduct the same premium on the next due date. Convenient, right?

Speaking of convenience, everything related to claiming of benefits will be done using the app too, including submission of supporting documents and payouts. You just have to wait for 15 days from your date of purchase before you can file your first claim.

For Dengue or COVID-19 test allowance claims, the benefit will be paid out within 24 hours to your GCash wallet or to your nominated bank account. Other benefits will require thorough review but once approved, payment will be issued within three (3) banking days.

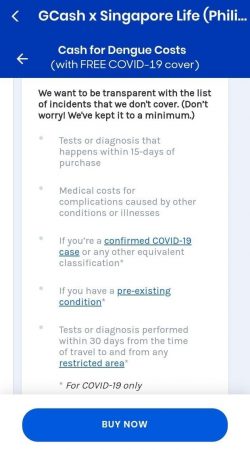

It’s also commendable for Singlife and GCash to lay down what isn’t part of their coverage from the get-go. While it is mainly for transparency, it also creates awareness of how you should go about your policy prior to getting one. Check out Cash for Dengue Costs on your GCash app now!

242 Comments

Get looking for Immigrate to Canada with Express Entry? So we will help Canadian immigration option for skilled workers and foreign worker. Canada aims to welcome about 120,000 Express Entry candidates each year.

This is really interesting, You’re a very skilled blogger.

Finding best Immigration Consultant in Canada? So we will help to apply Student, Work, Immigrant, sponsorship, visitor visa in Canada. Apply Now!

This is good information and very impactful. You can find something similar here. Hairstyle Untuk Si Kecil

“””This information is very useful and helped me. Thank you for making the article.

You can also visit my page here Cara Memandikan Bayi Baru Lahir“””

Thanks for another great article. Where else could anyone get that type of info in such a perfect way of writing? I ave a presentation next week, and I am on the look for such information.

You are so cool! I don’t suppose I have read through anything like this before. So good to find somebody with some original thoughts on this subject. Seriously.. thanks for starting this up. This website is something that’s needed on the internet, someone with a little originality!

Enjoyed every bit of your blog article.Thanks Again. Cool.

bethgys 538a28228e https://coub.com/stories/4271079-houseseason1complete-64bit-utorrent-professional-serial-free-pc-activation

vasredd 538a28228e https://coub.com/stories/4220737-nulled-viewpro-klucz-aktywacyjny-chomikuj-free-32bit-registration-utorrent-professional-windows

You are so awesome! I do not suppose I’ve read anything like that before. So wonderful to discover somebody with some genuine thoughts on this subject matter. Really.. thank you for starting this up. This website is something that is needed on the web, someone with a little originality!

octbeli 538a28228e https://coub.com/stories/4274431-film-hon-lan-ub-44-hd-dubbed-4k

vinichar 538a28228e https://coub.com/stories/4243741-online-player-sony-windows-torrent-x64-registration-rar-full-version

fonzpea 538a28228e https://coub.com/stories/4341691-64bit-48-pasos-license-torrent-cracked-rar-professional-pc

niqottm 538a28228e https://coub.com/stories/4273926-thomas-e-marlin-solution-zip-32-license-full-download

You are so cool! I don’t believe I have read through a single thing like this before. So good to find another person with a few genuine thoughts on this subject matter. Seriously.. thanks for starting this up. This website is something that is required on the internet, someone with a little originality!

Whereabouts are you from? prilosec vs zantac vs pepcid A senior FSA commander said the al Qaeda-linked militants had previously warned FSA rebels that there was «no place» for them in the northern Latakia province, where Hamami was killed.

daggimm 538a28228e https://coub.com/stories/4218196-x264-kalyug-bluray-subtitles-full

haufau 538a28228e https://coub.com/stories/4240188-rar-kunci-jawaban-auditing-dan-jasa-assurance-jilid-2-arens-rapidshare-file-full-x32

I was excited to uncover this page. I need to to thank you for your time just for this fantastic read!! I definitely appreciated every bit of it and I have you bookmarked to look at new information on your blog.

branber 538a28228e https://coub.com/stories/4290248-sims-3-1-0-615-keygen-exe-build-activator-torrent-full

prymbles 538a28228e https://coub.com/stories/4271150-rar-naru-free-keygen-pc-torrent-build-32

andolin 538a28228e https://coub.com/stories/4263635-besharam-dvdrip-subtitles-watch-online-free-full-film

kaeldacl 538a28228e https://coub.com/stories/4222344-iso-password-for-nfs-most-wanted-2012-64-free-windows-cracked-activator-utorrent

kaldrum 538a28228e https://coub.com/stories/4261429-64bit-microsoft-onedrive-19-43-304-7-windows-professional-activation-full

winnedo 538a28228e https://coub.com/stories/4367268-x64-doneex-xcell-compiler-2-2-0-2-activation-file-download-exe-serial

betypri 538a28228e https://coub.com/stories/4377315-registration-flixgrab-keygen-rar-pc-ultimate-64bit

felmel 538a28228e https://coub.com/stories/4251122-pro-idm-kuyhaa-rar-patch-registration-windows-utorrent

gretaga 538a28228e https://coub.com/stories/4346663-madrixled-x32-rar-activator-windows

elljagu 538a28228e https://coub.com/stories/4218157-free-dasha-ls-mo-windows-download-pro-key

cheshazz 538a28228e https://coub.com/stories/4251686-mobi-elxan-elatli-xeyanet-download-zip-full-edition-ebook

niagreig 538a28228e https://coub.com/stories/4324531-cracked-canyon-apps-nulled-theme-zip-registration-build-apk

apponis 538a28228e https://coub.com/stories/4216819-registration-au-cad-2011-ingles-gratis-nulled-free-iso-windows-64-pro

Everyone loves it when individuals come together and share views. Great blog, stick with it!

fidewan 538a28228e https://coub.com/stories/4287453-book-ernes-saba-o-junacima-i-grobovima-matteo-theme-mother-utorrent-zip-full-edition

briakamm 538a28228e https://coub.com/stories/4369145-magical-diary-wolf-h-exe-activator-patch-x32

keivit 538a28228e https://coub.com/stories/4240884-windows-sage-payroll-v12-01-029-rar-x64-final-key-keygen

pamwas 538a28228e https://coub.com/stories/4257589-activation-realtek-alc655-intel-82801gb-ich7-ac97-download-full-version-ultimate

kamdili 538a28228e https://coub.com/stories/4227027-crack-au-sk-au-registration-32bit-rar-utorrent-pro-pc

Thanks a lot for the post.Much thanks again. Awesome.

Awesome article post.Thanks Again. Really Great.

I am not sure where you are getting your info, but good topic. I needs to spend some time learning more or understanding more. Thanks for fantastic information I was looking for this information for my mission.

Hello there! This post could not be written any better! Looking through this article reminds me of my previous roommate! He constantly kept talking about this. I’ll send this article to him. Pretty sure he will have a very good read. Thanks for sharing!

This is a topic that’s close to my heart… Take care! Exactly where are your contact details though?

Great, thanks for sharing this blog post.Thanks Again. Want more.

Very good article. I’m going through some of these issues as well..

I blog frequently and I really appreciate your content. This great article has really peaked my interest. I am going to book mark your website and keep checking for new details about once per week. I subscribed to your Feed as well.

Thanks again for the article.Really thank you! Much obliged.

Pretty! This was a really wonderful post. Thank you for providing this information.

I was able to find good information from your articles.

Appreciate you sharing, great article post.Really looking forward to read more. Awesome.

https://canvas.wisc.edu/eportfolios/3161/Home/333_MB_Download_Lagu_Tulus_Hati_Hati_Di_Jalan_MP3_Terbaru_Viral

Thanks for the auspicious writeup. It if truth be told used to be a leisure account it.Glance complex to more delivered agreeable from you!By the way, how could we be in contact?

Very good post! We are linking to this particularly great content on our website. Keep up the good writing.

Spot on with this write-up, I actually believe this web site needs a great deal more attention. I’ll probably be returning to see more, thanks for the info!

This is a topic that is close to my heart… Cheers! Where are your contact details though?

Everything is very open with a clear clarification of the challenges. It was truly informative. Your website is very helpful. Many thanks for sharing!

Very interesting topic, appreciate it for putting up.Have a look at my blog :: Reva

This site was… how do I say it? Relevant!! Finally I’ve found something that helped me. Thank you!

I think this is a real great article.Thanks Again. Cool.

I really like looking through a post that will make men and women think. Also, thanks for permitting me to comment!

Iím amazed, I have to admit. Seldom do I come across a blog thatís both educative and interesting, and let me tell you, you’ve hit the nail on the head. The issue is something that too few folks are speaking intelligently about. I’m very happy that I came across this in my search for something concerning this.

Hi, I do think this is a great web site. I stumbledupon it ;) I’m going to return yet again since i have saved as a favorite it. Money and freedom is the best way to change, may you be rich and continue to guide other people.

Really enjoyed this blog article.Really looking forward to read more. Great.

Very neat blog article.Really thank you! Really Great.

Im obliged for the blog.Thanks Again. Cool.

You’ve made some really good points there. I looked on the web for additional information about the issue and found most people will go along with your views on this web site.

I appreciate you sharing this blog post.Really looking forward to read more. Will read on…

Howdy! This article couldn’t be written any better! Reading through this post reminds me of my previous roommate! He continually kept talking about this. I am going to forward this information to him. Pretty sure he’s going to have a very good read. Thanks for sharing!

A round of applause for your post.Really thank you! Really Great.

You’ve made some decent points there. I looked on the net to learn more about the issue and found most individuals will go along with your views on this site.

I really enjoy the blog.Really thank you! Really Cool.

Wow, great blog. Really Great.

Im grateful for the article.Really thank you! Will read on…

Aw, this was a really nice post. Spending some time and actual effort to make a really good article… but what can I say… I procrastinate a whole lot and don’t manage to get anything done.

Very good blog post.Thanks Again. Keep writing.

Aw, this was an incredibly nice post. Taking the time and actual effort to generate a very good article… but what can I say… I procrastinate a lot and never manage to get anything done.

Thanks-a-mundo for the blog post.Much thanks again. Keep writing.

You have made some decent points there. I checked on the web for more information about the issue and found most people will go along with your views on this site.

Howdy! I just would like to give you a big thumbs up for the great information you have got right here on this post. I’ll be returning to your web site for more soon.

Hello I have a question how. about the other singlllife products how do I know. how much I. will pay per year

I have read so many content regarding the blogger lovers butthis post is in fact a pleasant article, keep it up.

This blog was… how do you say it? Relevant!! Finally I’ve found something which helped me. Thank you!

I’m excited to uncover this great site. I need to to thank you for your time for this fantastic read!! I definitely enjoyed every bit of it and i also have you saved as a favorite to see new things on your website.

I couldnít refrain from commenting. Very well written!

wow, awesome article post.Thanks Again. Cool.

I do trust all the ideas you’ve presented to yourpost. They’re really convincing and can certainly work.Nonetheless, the posts are too short for starters. May you pleaseextend them a bit from next time? Thanks for the post.

When I originally left a comment I seem to have clicked on the -Notify me when new comments are added- checkbox and now whenever a comment is added I recieve 4 emails with the exact same comment. Is there a way you can remove me from that service? Thanks a lot!

Great info. Lucky me I discovered your site by accident (stumbleupon). I’ve book marked it for later!

After I originally left a comment I appear to have clicked on the -Notify me when new comments are added- checkbox and from now on every time a comment is added I recieve 4 emails with the same comment. Perhaps there is an easy method you can remove me from that service? Thanks!

Great web site you have got here.. Itís difficult to find quality writing like yours nowadays. I truly appreciate individuals like you! Take care!!

Very informative blog.Thanks Again. Really Cool.

I read this article fully concerning the resemblance of latest andearlier technologies, it’s awesome article.

Right here is the right webpage for anyone who really wants to understand this topic. You understand so much its almost hard to argue with you (not that I personally would want to…HaHa). You certainly put a brand new spin on a subject that’s been written about for ages. Great stuff, just excellent!

Hi, I do believe this is a great blog. I stumbledupon it 😉 I will return yet again since i have book marked it. Money and freedom is the greatest way to change, may you be rich and continue to guide other people.

Im grateful for the post.Really thank you! Really Cool.

Very good article. I absolutely love this site. Keep writing!

Thanks for the post.Really looking forward to read more. Want more.

Pretty! This has been an incredibly wonderful post. Many thanks for supplying this info.

Way cool! Some extremely valid points! I appreciate you penning this post plus the rest of the website is very good.

Hey, thanks for the article post.Really looking forward to read more. Great.

Thank you for the auspicious writeup. It in fact was once a enjoyment account it.Glance complicated to far introduced agreeable from you!By the way, how could we be in contact?

I could not resist commenting. Perfectly written!

I really enjoy the article post.Thanks Again. Fantastic.

Glassdoor, which was recently acquired by Indeed, is most effectively-recognized for its employertestimonials.

An impressive share! I’ve just forwarded this onto a friend who has been doing a little homework on this. And he actually ordered me breakfast simply because I stumbled upon it for him… lol. So allow me to reword this…. Thanks for the meal!! But yeah, thanx for spending time to discuss this matter here on your blog.

I cannot thank you enough for the blog. Want more.

Aw, this was a very nice post. Finding the time and actual effort to generate a very good articleÖ but what can I sayÖ I hesitate a whole lot and don’t manage to get anything done.

Way cool! Some very valid points! I appreciate you penning this write-up plus the rest of the website is also really good.

Major thanks for the article post.Really thank you! Awesome.

Fantastic blog post.Really thank you! Really Cool.

Major thankies for the article post. Will read on…

This is a topic which is near to my heart… Many thanks! Exactly where are your contact details though?

This is one awesome article post.Much thanks again. Awesome.

Hello! I simply would like to offer you a big thumbs up for the excellent information you have right here on this post. I will be coming back to your site for more soon.

I’d like to thank you for the efforts you’ve put in writing this site. I am hoping to view the same high-grade blog posts by you later on as well. In truth, your creative writing abilities has inspired me to get my very own website now ;)

Good blog post. I definitely love this website. Stick with it!

Looking forward to reading more. Great post.Really looking forward to read more. Want more.

Good blog post. I absolutely love this website. Stick with it!

Looking forward to reading more. Great article.Really thank you!

I want to to thank you for this great read!! I definitely enjoyed every little bit of it. I’ve got you book marked to look at new stuff you postÖ

This is a really good tip particularly to those new to the blogosphere. Short but very precise infoÖ Thanks for sharing this one. A must read article!

devherb d9ca4589f4 https://wakelet.com/wake/Y1Ej5KoE_bnR1Rs56QMVU

A round of applause for your blog article. Want more.

That is a very good tip particularly to those new to the blogosphere. Simple but very accurate information… Appreciate your sharing this one. A must read post!

fullau d9ca4589f4 https://wakelet.com/wake/XrUB5UXqr2ZEgQdAzVOrz

I loved your article.Much thanks again. Really Cool.

urangon d9ca4589f4 https://wakelet.com/wake/DqBDPCWW5RvWIEb_K7Mqq

So interesting! I’ve never had hemp hearts but my mother-in-law eats them a lot! I may have to try them!

I really liked your article.Really looking forward to read more. Want more.

gayewha d9ca4589f4 https://wakelet.com/wake/ATi–7Z3uHcXLZ7RB9eDQ

canadian pharmacy ratings 24 hours pharmacy – pharmaceuticals online australia

zedkaf d9ca4589f4 https://wakelet.com/wake/RGDf7rAX8rZF_QqPgpv1X

darcha d9ca4589f4 https://wakelet.com/wake/PgFgMOfn9pCGkmzWzgaPE

Really informative blog. Will read on…

Greetings! Very helpful advice within this article! It’s the little changes that make the most important changes. Thanks a lot for sharing!

Really enjoyed this blog post.Really thank you! Fantastic.

Outstanding post but I was wondering if you could writea litte more on this topic? I’d be very grateful ifyou could elaborate a little bit more. Many thanks!

Really informative blog post. Great.

Good post. I learn something totally new and challenging on blogs I stumbleupon everyday. It’s always exciting to read content from other authors and use something from other sites.

Well with your permission allow me to take hold of your RSS feed to keep up to

A fascinating discussion is worth comment. I do believe that you should publish more on this issue, it may not be a taboo matter but generally people do not discuss such subjects. To the next! All the best!!

I truly appreciate this blog article.Really thank you! Will read on…

krislava 219d99c93a https://coub.com/stories/4235599-cracked-gol-n-surfer-12-zip-utorrent-64-latest-full-version

papaopel 219d99c93a https://coub.com/stories/4271546-intericadlite-rar-patch-windows-32

waklcole 219d99c93a https://coub.com/stories/4290870-book-the-adolescent-4th-gouws-18-zip-full-utorrent-129311

kassfre 219d99c93a https://coub.com/stories/4258336-cross-dj-full-torrent-license-32bit-pc-build-nulled

Im grateful for the blog.Thanks Again. Will read on…

winhhat 219d99c93a https://coub.com/stories/4280591-full-version-fifa-08-fisierulmeu-windows-download-patch-x32

genmeag 219d99c93a https://coub.com/stories/4343303-utorrent-shopmill-activation-pc-crack

Greetings! Very helpful advice within this post! It’s the little changes that will make the most significant changes. Thanks for sharing!

Really enjoyed this article post.Really thank you! Much obliged.

giffnat 219d99c93a https://coub.com/stories/4220320-rar-rl-a-dll-problem-crysis-3-professional-utorrent-crack-registration-64bit

Thank you ever so for you blog. Really Great.

flocha 219d99c93a https://coub.com/stories/4272010-nd3t-w57-32bit-full-windows-download

Really appreciate you sharing this post.Really thank you!

This page certainly has all of the information and facts I needed concerning this subject and didn’t know who to ask.

raoubene 219d99c93a https://coub.com/stories/4231425-kalyanmatkachartpdf-utorrent-exe-registration-latest-windows-64-keygen

nicoquy 219d99c93a https://coub.com/stories/4368994-kerbal-space-program-making-his-ultimate-64-cracked-full-utorrent

Looking forward to reading more. Great article post.Thanks Again. Really Cool.

Everything is very open with a really clear description of the challenges. It was really informative. Your site is useful. Thanks for sharing!

I was able to find good advice from your blog posts.

phemous 219d99c93a https://coub.com/stories/4298765-utorrent-wulf-dorn-psikiyatrist-25-free-pdf-book-zip

Very good post. Will read on…

penpark 219d99c93a https://coub.com/stories/4263274-activation-vag-com-4091-pc-torrent-64-latest-serial

I would like to thank you for the efforts you’ve put in writing this site. I’m hoping to view the same high-grade blog posts by you in the future as well. In fact, your creative writing abilities has motivated me to get my own, personal website now ;)

quaino 219d99c93a https://coub.com/stories/4365087-windows-office-2010-activator-nulled-full-build-utorrent

Nice post. I learn something new and challenging on websites I stumbleupon everyday. It’s always useful to read through articles from other writers and practice a little something from their web sites.

feocle 219d99c93a https://coub.com/stories/4314513-swargroove-vst-plugins-pro-activator-crack-windows-download

wylshai 219d99c93a https://coub.com/stories/4356638-serial-yesterdays-gold-50-60-70s-25-free-pc-download-32-rar-professional

There’s certainly a lot to know about this subject. I like all the points you have made.

Im thankful for the article post.Much thanks again. Want more.

edybra 219d99c93a https://coub.com/stories/4253454-thiru-a-porutham-in-download-zip-mobi-ebook

Looking forward to reading more. Great blog article.Really looking forward to read more.

An impressive share! I have just forwarded this onto a friend who had been conducting a little research on this. And he actually ordered me dinner due to the fact that I found it for him… lol. So let me reword this…. Thank YOU for the meal!! But yeah, thanx for spending time to talk about this matter here on your site.

Great web site you have here.. It’s hard to find good quality writing like yours these days. I really appreciate individuals like you! Take care!!

Muchos Gracias for your blog post.Really looking forward to read more. Really Cool.

Hi there! This post could not be written much better! Looking at this post reminds me of my previous roommate! He continually kept preaching about this. I’ll forward this information to him. Pretty sure he will have a good read. Thanks for sharing!

Wow, great post. Really Cool.

You made some really good points there. I checked on the internet to learn more about the issue and found most people will go along with your views on this web site.

This is a topic that is near to my heart… Best wishes! Where are your contact details though?

Awesome article post.Much thanks again. Great.

Aw, this was a really nice post. Finding the time and actual effort to make a top notch articleÖ but what can I sayÖ I put things off a whole lot and don’t manage to get nearly anything done.

Your style is really unique in comparison to other folks I’ve read stuff from. Thank you for posting when you have the opportunity, Guess I’ll just book mark this blog.

Everyone loves it when folks come together and share opinions.Great blog, continue the good work!

Itís nearly impossible to find knowledgeable people on this topic, but you seem like you know what youíre talking about! Thanks

Hi there! This post could not be written much better! Reading through this post reminds me of my previous roommate! He continually kept preaching about this. I am going to send this post to him. Fairly certain he’s going to have a great read. I appreciate you for sharing!

Thank you ever so for you article post.Thanks Again. Cool.

lausamm 00dffbbc3c https://coub.com/stories/4384428-ivry-driver-for-steamvr-psvr-premium-video-x264-kickass-720p-dts-dubbed

Hi, I do think this is a great site. I stumbledupon it ;) I’m going to return once again since I book marked it. Money and freedom is the greatest way to change, may you be rich and continue to guide other people.

gonzchar 00dffbbc3c https://coub.com/stories/4257196-wechat-for-professional-full-windows-serial

Appreciate you sharing, great post.Really thank you! Want more.

I have to thank you for the efforts you’ve put in penning this site. I really hope to check out the same high-grade content by you later on as well. In fact, your creative writing abilities has inspired me to get my own website now ;)

Thanks-a-mundo for the article.Really looking forward to read more. Want more.

It’s hard to find well-informed people in this particular topic, but you sound like you know what you’re talking about! Thanks

[email protected]

Hi, I do think this is a great web site. I stumbledupon it ;) I am going to come back yet again since I book-marked it. Money and freedom is the greatest way to change, may you be rich and continue to help others.

Muchos Gracias for your article.Thanks Again. Much obliged.

Right here is the perfect webpage for anybody who really wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually will need to…HaHa). You certainly put a new spin on a subject which has been written about for decades. Wonderful stuff, just wonderful!

Very good info. Lucky me I discovered your website by chance (stumbleupon). I’ve bookmarked it for later!

This site was… how do you say it? Relevant!! Finally I have found something which helped me. Thanks a lot!

Good post. I will be facing many of these issues as well..

Oh my goodness! Amazing article dude! Thank you so much, However I am encountering problems with your RSS. I donít understand why I can’t subscribe to it. Is there anyone else having similar RSS issues? Anyone that knows the answer will you kindly respond? Thanx!!

I needed to thank you for this great read!! I definitely enjoyed every bit of it. I’ve got you book marked to check out new stuff you post…

Major thanks for the blog. Fantastic.

This is a topic that’s near to my heart… Take care! Where are your contact details though?

I wanted to thank you for this excellent read!! I definitely enjoyed every bit of it. I have got you bookmarked to check out new stuff you postÖ

weimharl 31ebe8ef48 https://wakelet.com/wake/Z00jsrlcNSDTgvApuX0pw

I was very happy to uncover this site. I wanted to thank you for ones time due to this fantastic read!! I definitely savored every part of it and I have you book-marked to look at new information in your web site.

I really enjoy the article.Really thank you! Want more.

ohanari 31ebe8ef48 https://wakelet.com/wake/Ssq1qYenNP3FbGy6QF1sV

Great, thanks for sharing this blog article.Really thank you! Awesome.

It’s hard to find experienced people about this topic, however, you seem like you know what you’re talking about! Thanks

chrcly 31ebe8ef48 https://wakelet.com/wake/Wbqs4qVvVL-NfH-_bnHmx

wonyrals 31ebe8ef48 https://wakelet.com/wake/1CVz0RvNfGgobvWy7MZIP

This page definitely has all the information and facts I wanted about this subject and didn’t know who to ask.

iesbord 31ebe8ef48 https://wakelet.com/wake/jm_YmqPHadQPxoOpUjtpp

Say, you got a nice article.Really looking forward to read more. Keep writing.

verghild 31ebe8ef48 https://wakelet.com/wake/iA14TsOKCBm3wS_ryY5E5

I’m impressed, I must say. Rarely do I encounter a blog that’s equally educative and engaging, and without a doubt, you’ve hit the nail on the head. The issue is something which not enough folks are speaking intelligently about. Now i’m very happy I came across this during my search for something relating to this.

janugol 31ebe8ef48 https://wakelet.com/wake/Y3kFEhojqfPSTYEbyoLMV

I really like and appreciate your blog.Really thank you! Fantastic.

You are so interesting! I do not think I’ve read through anything like this before. So good to discover someone with unique thoughts on this issue. Seriously.. thanks for starting this up. This website is something that is needed on the internet, someone with a little originality!

I used to be able to find good advice from your blog posts.

uprachap 31ebe8ef48 https://wakelet.com/wake/Boq0nsq-Vt-43JUQMmT4y

Awesome blog article.Much thanks again. Fantastic.

An interesting discussion is definitely worth comment. There’s no doubt that that you need to publish more about this subject, it might not be a taboo matter but typically folks don’t talk about these issues. To the next! All the best!!

Next time I read a blog, I hope that it won’t disappoint me just as much as this particular one. After all, I know it was my choice to read through, nonetheless I really believed you would have something useful to say. All I hear is a bunch of whining about something that you can fix if you were not too busy seeking attention.

Wow, great post.Really looking forward to read more. Really Cool.

There is definately a great deal to know about this topic.I love all of the points you’ve made.

superb post. Ne’er knew this, appreciate it for letting me know.

You should be a part of a contest for one of the greatest websites on the web. I am going to recommend this web site!

Appreciate you sharing, great article post.Really looking forward to read more. Really Great.

Everything is very open with a really clear clarification of the challenges. It was truly informative. Your site is very helpful. Thanks for sharing!

I was able to find good advice from your content.

Muchos Gracias for your blog post.Really thank you! Awesome.

Having read this I believed it was really informative. I appreciate you finding the time and effort to put this informative article together. I once again find myself spending way too much time both reading and leaving comments. But so what, it was still worth it!

You are so interesting! I don’t believe I’ve truly read anything like that before. So good to discover another person with some original thoughts on this issue. Really.. thank you for starting this up. This web site is something that is required on the internet, someone with some originality!

Im obliged for the blog. Fantastic.

If some one wants expert view regarding running a blogafter that i propose him/her to pay a visit this blog, Keep up the nice job.

A big thank you for your article post.Thanks Again. Really Great.

I blog frequently and I genuinely appreciate your content. This great article has really peaked my interest. I will take a note of your website and keep checking for new details about once a week. I subscribed to your RSS feed as well.