AirAsia Philippines through its Super App has successfully shifted from being more than just an airline to becoming a full digital travel and lifestyle platform in the Philippines and the rest of Asean.

Since last year, the airline has introduced collaboration with different industry partners which were made available online for guests, and embarked on different endeavors such as partnerships with different online payment merchants to make passenger experience holistic and much easier.

AirAsia’s digital transformation and shift to online transactions came in handy as the Philippines and the rest of the world had to deal with the global health crisis which minimized face-to-face transactions in dealing with business.

The airasia Super App has thousands of active app users in the Philippines based on the 5,000 monthly app downloads for smartphones and 640,000 unique user visits for the app.

On the occasion of the National Cyber Security month, AirAsia Philippines is advocating netizens to value their security especially whenever logging on to the internet. It is imperative that all must consciously think of what they like, share, subscribe or download and be wary of the websites they are visiting and the applications they are opening, or end up compromising their digital information.

It is also for this reason that AirAsia Philippines is giving these simple, yet effective ways of protecting your personal details against cybercriminals.

AirAsia Philippines ICT Head Dennis Crimen said, “Cybersecurity is everyone’s concern. It is a known fact that most of the current systems are already fortified with enough security features; from the people that manage them, down to the individual applications. Sad to say, the weakest link in upholding cyber security is still the end user. No matter how secure the systems are, the users’ activities are the ones that cause most of the data breaches.”

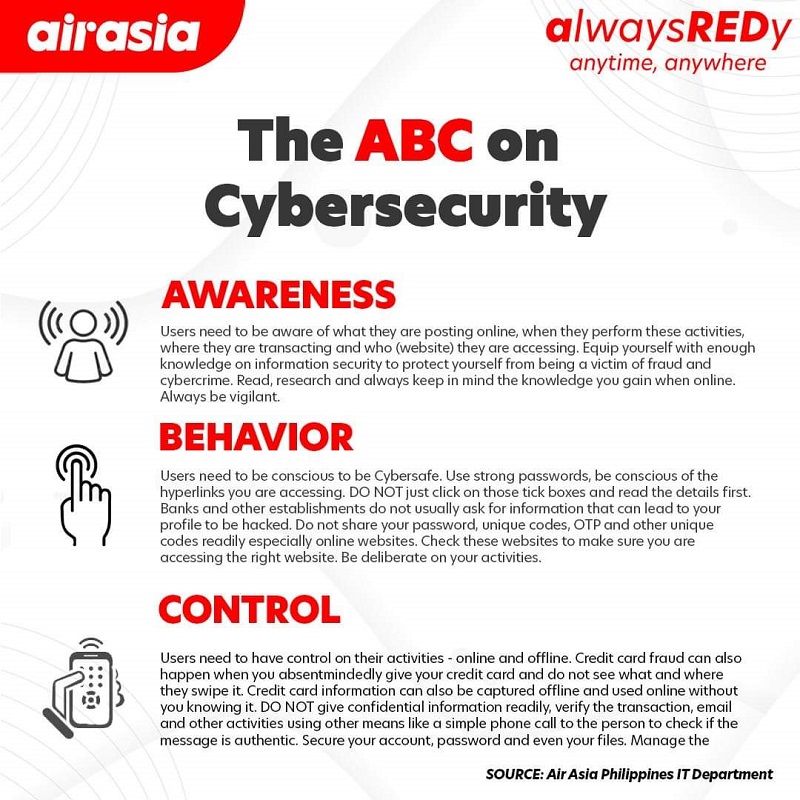

As simple as clicking a link in a website, Mr. Crimen advises netizens of a simple A-B-C’s to protecting their personal details:

A – Awareness: Users need to be aware of what they are posting online, when they perform these activities, where they are transacting and who (website) they are accessing. Netizens should equip themselves with enough knowledge on information security to avoid falling victim to fraud and cybercrime. Read, research and always keep in mind the knowledge you gain whenever online. Always be vigilant.

B – Behavior: Users need to be conscious to be Cybersafe. DO NOT share your password, unique codes, OTP and other unique codes online. Use strong passwords for your personal accounts and regularly change them. Always be conscious of the hyperlinks you are accessing. DO NOT just click on those tick boxes and read the details first. Remember, banks and other establishments do not usually ask for information that can lead to the vulnerability of your profile. Always check if you are accessing the correct website before clicking anything inside it.

C – Control: Users need to have control on their activities – online and offline. Credit card fraud can also happen when you absentmindedly give your credit card and do not see what and where they swipe it. Credit card information can also be captured offline and used online without you knowing it.

DO NOT give confidential information readily, verify the transaction, email and other activities using other means like a simple phone call to check if the message is authentic. Secure your account, password and even your files. Manage the things you can control.

Data from datareportal.com revealed that the number of internet users in the Philippines increased by 4.2 million between 2020 and 2021. Last January, the number of Filipino internet users logged at a high of 73.91 million. Mobile internet users meanwhile recorded a high of 152.4 million. An average Filipino on the other hand spends 4 hours and 15 minutes each day on the internet.

However, as the number of people engaged in the internet and e-commerce increased, so as the number of cybercrimes and online fraud. Cybercrime activities include phishing, smishing, vishing and other online fraud schemes that target bank clients, credit card holders, e-wallet accounts, online shopping and other users of online financial services.

The National Bureau of Investigation (NBI) Cybercrime Division reported an increase of 200% in phishing and other online crimes since the onset of the pandemic in March 2020. The Philippine National Police Cybersecurity Group has noted a 37% increase in cybercrimes from March to September 2020.

Accidentally compromising your personal details to online syndicates is like giving all access to your bank, personal and social media accounts. This in turn could create long term problems with your finances and personal life.

Remember, in this time of digital age and technological advancements, cybercriminals would always find ways to victimize unsuspecting netizens. Question is, are you a click ahead of them? Valuing and safeguarding personal details and other online data will not only save you from falling victim, but it will also create a good habit of getting secured.