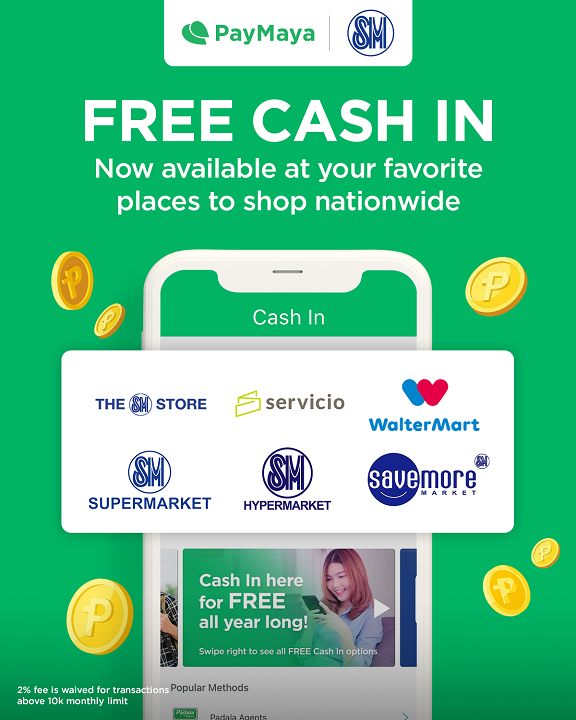

Going cashless is now made easier than ever as PayMaya works with SM to allow customers to cash in to their PayMaya accounts for FREE at The SM Store, SM Supermarket, and SM Hypermarket outlets nationwide.

These establishments are the latest additions to PayMaya’s growing list of over 90,000 FREE cash in touchpoints which includes Servicio, Waltermart, Savemore, BPI (via linked account), Unionbank (via linked account), Smart Padala, TrueMoney, Ministop, Robinsons Supermarket, Southstar Drug, Bayad Center, TouchPay, and many others. Customers can also receive a P20 cashback covering their transfer fee when they cash in to PayMaya via Instapay until the end of the year.

PayMaya’s FREE cash in touchpoints make up 8 out of 10 of its over 110,000 total cash in touchpoints nationwide, unmatched by other e-wallets. With more FREE cash in channels to choose from, you can easily find one that is most convenient for you – whether you want to do it at your go-to supermarket, at the sari-sari store in your community, or from the comforts of your home.

To check out the complete list of PayMaya’s free cash in touchpoints, visit the Cash In button on the PayMaya app and look for the icons with the ‘no fees’ sticker.

With these new additions to PayMaya’s FREE cash in touchpoints, you can enjoy a safer and more convenient payment experience when shopping for their holiday essentials without the hassle of paying additional fees.

Cashing in FOR FREE at these establishments is easy. For example, for The SM Store – all you have to do is follow these simple steps:

- On your PayMaya app, select the “Cash In” icon on the home screen.

- Select The SM Store

- Enter the desired amount, then select “Continue.”

- Go to the SM Bills Payment counter and present the generated 7-digit code along with your payment to the cashier.

- Wait for an SMS confirmation before leaving the store.

Once you already have funds in your PayMaya account, you can now enjoy safe and convenient contactless transactions for your everyday needs – including purchasing your essentials at The SM Store, or in the shops at SM via PayMaya QR or by tapping your PayMaya physical card.

“Our new collaboration with SM is just one of the many ways PayMaya is making cashless payments frictionless for Filipinos. By offering FREE cash in at their go-to establishments like The SM Store, SM Supermarket, and SM Hypermarket, we’re making cashless payments more accessible to customers. This is most relevant, especially during the holiday season,” said Pepe Torres, Chief Marketing Officer at PayMaya Philippines.

“As more customers flock to our stores for their holiday shopping, providing them a safe and hygienic environment is our top priority. We’re happy to work with PayMaya to promote contactless transactions in our establishments by offering free cash in. With this, we are confident that more customers will be encouraged to utilize safer contactless payment for their transactions,” Dhinno Francis Tiu, SVP and Business Development Head at The SM Store.

Now that cashing in and paying with your PayMaya account is this easy and hassle-free, it’s time to get in on cashless payments! Download the PayMaya app at https://official.paymaya.com/CAK1/425eb133 and register an account to start enjoying safe and convenient payments today.

PayMaya is the only end-to-end digital payments ecosystem enabler in the Philippines, with platforms and services that cut across consumers, merchants, communities, and government. It provides more than 41 million Filipinos access to financial services through its consumer platforms. Customers can conveniently pay, add money, cash out or remit through its over 380,000 digital touchpoints nationwide.

Its Smart Padala by PayMaya network of over 60,000 partner agent touchpoints serves as last-mile digital financial hubs in communities, providing the unbanked and underserved access to digital services. Through its enterprise business, it is the largest digital payments processor for key industries in the country, including “every day” merchants such as the largest retail, food, gas, and eCommerce merchants, as well as government agencies and units.