Bayad, the country’s authority in bills payment and Meralco’s full service fintech subsidiary has forged partnership with UBX, the leading open finance platform in the Philippines.

Under the agreement, i2i, the banking-as-a-service venture of UBX, will leverage the network of billers of Bayad, allowing i2i banking agents to process payments for Meralco and Home Credit among others.

Apart from this, Bayad and UBX continuously recalibrate its interoperability as they are keen to scale up their ecosystem of billers from basic utilities such as electricity and water, cable & internet, to government contributions and loan payments, school tuition fees, online shopping, insurance, and many others.

This vision of providing a one-stop-shop solution will deliver a more open and accessible financial services to individuals and thousands of micro, small and medium-sized enterprises (MSMES) in the country.

With this, sari-sari store owners, carinderia operators, and stall owners in public markets, can rely on Home Credit loans to keep their businesses going, conveniently settle their Meralco bills, and access other bills payment services that respond to the ever-changing needs of Filipinos amid the fast-paced environment brought about by the new normal.

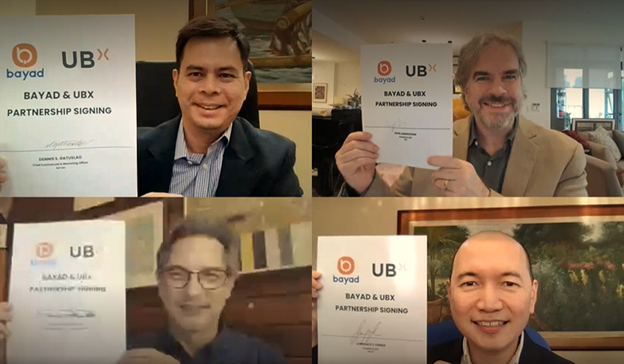

Bayad’s President and CEO, Lawrence Y. Ferrer underscored, “As we leverage on digital financial technology, we proactively respond to market developments and adapt innovations in banking. With this, we partnered with UBX to make financial services more accessible and convenient to our kababayans. With our partnership, we will be able to help communities bounce back in the new normal. We at Bayad, will continue to create positive strides by expanding our bills payment solutions while offering the convenience of real-time posting.”

UBX President and CEO, John Januszczak also shared “We are committed to constantly improving our services and in bringing financial services closer to those who need them. Our partnership with Bayad will provide seamless bills payment transactions to our customers, allowing us to further strengthen our initiatives for financial inclusion.”