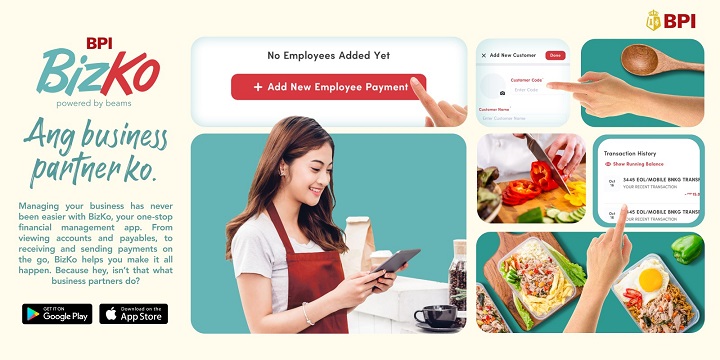

Bank of the Philippine Islands (BPI) recently launched BPI BizKo, a simple, affordable, and convenient subscription-based digital banking platform that enables micro, small, and medium enterprises (MSMEs) to manage their business finances and provides an integrated online system for invoicing and collection.

The all-in-one online platform available via app and web offers MSMEs immediate access to their account information – to view balances, deposits, and payables, regularly pay employees, suppliers, utilities, and government dues, create digital invoices under their business name, get invoice number reminders to avoid duplication, and receive and monitor payments through its intuitive invoicing system. With your BPI Online Banking Account linked to BizKo, entrepreneurs can now skip the hassle of submitting multiple requirements for onboarding, and instead easily enroll and transact via BPI BizKo anytime, anywhere.

With BPI BizKo, MSMEs can handle everyday financial and accounting processes without the need to move funds to another e-wallet or bank account, or physically go to the branch. This helps in streamlining the cash flow to and from their partners and customers for more accurate and hassle-free monitoring.

While these are benefits that come with having a corporate online banking platform, these often require a significant initial deposit and the maintenance of a daily balance that some MSMEs struggle with. BPI BizKo allows them to access these services through flexible and friendly subscription plans available in monthly and annual terms.

BPI BizKo account creation and subscription plans

BPI BizKo is accessible through its official website www.bpibizko.com and mobile app for download via App Store and Play Store. Business owners can create a BizKo account by clicking on the ‘open account’ online to get started. Having an existing BPI deposit account and BPI Online Banking account is a must to enroll in BizKo.

Customers can choose from four subscription plans, available in monthly or annual payment terms that start at Php 50 and Php 100 per month for basic and premium plans respectively. A minimum fee of Php 10 will be charged for each successful transaction. Fees vary, depending on the transaction type and subscription plan.

| BizKo Facilities |

| Free Account Viewing and Transaction History |

| Bills Payment |

| Transfer to BPI Accounts |

| Transfer to Other Banks |

| Payroll |

| Government Payments |

| Invoice – Generation and Payment |

| Request Money – Generation and Payment |

| Payment Link Generation and Payment |

| Financial Report Generation |

On top of these features, BPI is also working on BizKo to allow customers to accept credit card and Gcash as payment methods for their businesses, enabling MSMEs to become cashless as COVID-19 continues to accelerate digital payments.

Like BPI’s other mobile apps, BizKo is protected by two-factor authentication. For added convenience, biometrics activation is available. Additional security features include PIN nomination for any change to the BizKo user’s account settings, email notifications for each login and transaction, and set-up of BizKo transactional limits.

Meanwhile, BizKo’s infrastructure employs best-in-class security measures for encryption.

Launch promo: Free three-month trial

Get a free three-month trial subscription when you enroll in BizKo from February 28 to May 31, 2022. To claim this, activate BizKo and wait for the promo code pop up, then input this in the payment confirmation page.

Be the first to experience BPI BizKo by joining the app launch on March 10, 2022, Thursday at 3:30PM via Zoom. Register to the event through https://l.bpi.com.ph/BizKoLaunch.