- Recovery: Global insurance premiums increased by 5.1% or more than EUR 200bn in 2021

- Setback: Only 4.8% growth is expected in 2022 – against the background of a global inflation rate of 6.2%

- Outlook: Rising risks from social, political, and economic changes drive global premium growth of 4.8% p.a. over the next decade

- Turnaround: The Philippine insurance market returned to bumper growth of 26.7% in 2021, after declining in 2020

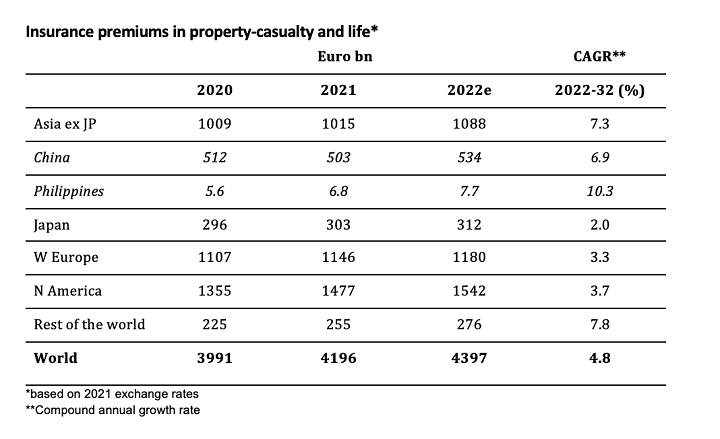

Today, Allianz published its latest “Global Insurance Report”, which analyzes the development of insurance markets worldwide. According to the report, global premiums grew by 5.1% in 2021 (life: +4.4%; p&c: +6.3%), thanks to strong economic tailwinds, rising risk awareness, and record-high savings buoyed by booming markets. Total premium income reached EUR 4.2trn (life: EUR 2.5trn and p&c: EUR 1.7trn). But what made 2021 really remarkable is the composition of premium growth: More than two-thirds were generated in Western Europe and North America, with the US market alone accounting for half of the increase. Thus, 2021 represents an unusual end to the past decade in which growth was much lower (+3.6% per year on average) and driven by Asia, which accounted for 40% of all additional premiums, more than half of them written in China. As a consequence, China’s global market share doubled to 12%.

2022 was expected to be another bumper year for the insurance industry, but the invasion of Ukraine has dashed those hopes. Premium income is likely to grow by roughly 1pp slower than originally assumed as the war takes its toll on economic activity and confidence, even as inflation supports the top line. Overall, global premium income is expected to grow by +4.8% in 2022, with life and p&c developing almost in step (+4.9% and +4.6% respectively). This figure must be considered against the backdrop of a global inflation rate of 6.2% this year.

Despite the great uncertainties today, Allianz is not too pessimistic about the more distant future. After all, these uncertainties are precisely the breeding ground for rising risk awareness; they reinforce the impact of the two megatrends of climate and demographic change, which will continue to be the main drivers of demand for risk protection. Overall, Allianz expects an annual growth of +4.8% over the next 10 years (life: +4.9%; p&c: +4.6%). This corresponds to an increase in premium income by +67% or EUR2.8trn by 2032, of which just under EUR1.8trn will be generated by the life segment (+69%) and just over EUR1trn by the p&c segment (+63%).

“The pandemic and the war in Ukraine are wake-up calls for better risk management, and even more demand for protection,” said Ludovic Subran, chief economist of Allianz. “The industry must succeed in maintaining its economic and social relevance, offering innovative solutions for new and rising risks. The questions of insurability and affordability are likely to become increasingly urgent in the coming years. This requires a level of creativity and collaboration with all stakeholders, customers, carriers, and policy makers even beyond previous efforts.”

Asia (excluding Japan) recorded a meager increase of only 0.6% in total premium income (life: 0.3%, P&C: 1.4%). The main reason was the setback in China (-1.7%). Total premium income exceeded EUR 1trn. Despite the rising uncertainties form the Ukraine war and Covid-19, growth is likely to accelerate to 7.2% in 2022 (life: 7.0%, p&c 7.6%). Average growth over the next ten years is expected to settle at 7.3% (life: 7.5%, non-life: 6.8%), slightly below the level of the last decade (7.5%).

“The China hype might be over,” said Michaela Grimm, co-author of the report. “In light of recent changes in China and the world, we have lowered our long-term growth forecast for the Chinese insurance market to “only” 6.9%; this compares to 9.2% in the previous decade. But even so, the global insurance market will continue to shift to the East. Around 42% of new premiums will be written in Asia (excluding Japan), half of which is likely to come from China alone. Anyone looking for growth will still have to turn to Asia. That won’t change in the coming years.”

Last year’s premium development reflected the economic recovery in 2021. The Philippines’ insurance market recorded a 21.6% growth after a mere 1.2% growth in the previous year. Main driver was the life segment, which posted very strong growth (25.4%), benefitting from the increased risk awareness in the wake of the Covid-19 crisis. With 12.6% p&c premium growth was markedly lower, but nevertheless did the total premium volume slightly surpass the pre-crisis level of 2019, making up for the market slump in 2020. For 2022, Allianz expects growth to “normalize” at 13.0% (life: 13.5%, p&c: 11.5%). Over the entire next decade, average growth should continue to reach double-digits, with 10.3% per year (life: 10.8%, p&c: 8.8%), reflecting the backlog demand in the Philippines’ insurance market. Even in regional comparison the insurance penetration is still comparatively low, with total premiums amounting to 2.1% of GDP compared to 4.3% in the region.

“Allianz PNB Life achieved the Top 4 position in over-all Gross Written Premiums six years from the company’s inception thanks to the trust of our customers,” said Allianz PNB Life President and CEO, Alexander Grenz. “We are also the fastest growing life insurance company in the Philippines for two years in a row because of the dedication and focus of our Life Changers. We are all driven by our purpose to secure the future of Filipino families and look forward to playing an even more significant role in bridging the insurance gap in the country.”

Insurance premiums in property-casualty and life