Filipinos can now dip their toes in the world of virtual assets and cryptocurrencies (crypto) with the help of the trusted e-wallet brand PayMaya.

Today, the digital financial services leader announced that it launched its cryptocurrency (crypto) feature through its all-in-one finance app experience, enabling Filipinos to easily buy and earn digital assets such as Bitcoin and Ethereum for as low as P1.

For many of us, crypto can be challenging. Usually, you need to download and register for a crypto account and subject yourself to a verification process. You also need to have a bank account or e-wallet app as a fund source.

With this development, PayMaya makes it easier than ever for all of us to get into crypto by providing an all-in-one experience. There is no need to register for another account, apply for an upgrade, or use another app. Unlike other e-wallets and apps, you can learn to use crypto, cash in to your wallet, buy and sell coins, and spend your crypto earnings without leaving your PayMaya account.

All you need to have is an upgraded PayMaya account to start trading in a variety of the most popular coins directly from your PayMaya wallet in Philippine Pesos. You can also seamlessly buy and sell crypto anytime with no extra cash in and cash out fees.

PayMaya is both an Electronic Money Issuer (EMI) and Virtual Asset Services Provider (VASP), licensed by the Bangko Sentral ng Pilipinas (BSP). With PayMaya’s strong track record of security and reliability with its 99.9% app uptime, consumers can enjoy safe and legitimate crypto transactions.

PayMaya is currently rolling out the feature progressively to its base. Other popular coins and tokens available for trading are Cardano (ADA), Chainlink (LINK), Uniswap (UNI), Solana (SOL), Quant (QNT), Polkadot (DOT), Polygon (MATIC), and Tether (USDT), with more coming soon.

PayMaya developed this feature under its Invest platform in connection with Coinbase Institutional. Coinbase is the largest publicly traded crypto company in the world and the trusted bridge to the crypto-economy. Coinbase Institutional offers a comprehensive suite of products and services including custody, prime brokerage, trading tools, and analytics, and an enterprise infrastructure built on top of a robust security platform. Coinbase Institutional provides the scale and stability needed to successfully participate in the crypto economy.

“We’re excited to offer this new feature to our users – especially as more Filipinos become increasingly interested in cryptocurrency. Being at the forefront of digital payments and financial services, offering crypto is a natural expansion for us as we build the Philippines’ most accessible end-to-end money platform,” said Shailesh Baidwan, President of PayMaya Philippines.

Crypto made easy for every Filipino

Upgraded PayMaya users can conveniently access this feature on the PayMaya app. If you’re new to PayMaya, registration only takes minutes, and you can easily upgrade your account – all you need is one valid ID and a video selfie.

Once you upgrade your PayMaya account, you can now unlock a simple, seamless, and beginner-friendly way to invest in crypto on PayMaya.

To help you understand the basics of crypto, PayMaya gives you access to tutorials and additional guided content in the app. Once you’re ready, you can enjoy a seamless and easy-to-navigate interface for your transactions as you buy, sell, hold, and even cash out your earnings – all in one app!

Cashing in is easy because PayMaya boasts over 110,000 cash-in touchpoints nationwide – with 90,000 outlets offering this service FOR FREE. You can also enjoy flexibility when it comes to enjoying your crypto earnings – from using it to pay your bills, shop online or in-stores, or cashing out via bank transfers in real-time!

Start your crypto journey

To start buying crypto on your PayMaya app, follow these simple steps:

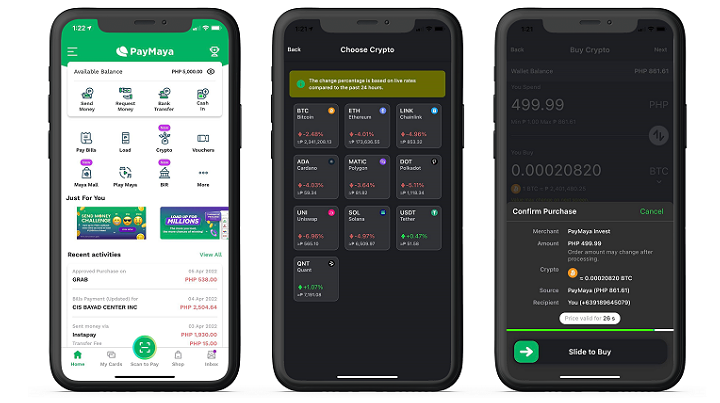

- Tap Crypto on the PayMaya homepage.

- Tap Buy on the bottom of the screen, then select the desired cryptocurrency.

- Input the desired Philippine Peso (PHP) amount you want to spend. You will see the equivalent cryptocurrency value based on an estimated market price. Then, tap Next on the upper right hand of the screen.

- A Confirm Purchase tab will pop up. On this tab, you will see the amount in PHP you will be spending and the amount of cryptocurrency you will be receiving through this transaction. Once you are ok with the details, you may confirm your purchase and slide to buy.

Once you purchase your desired cryptocurrency, the amount will reflect on your app’s Crypto page.

There you have it – you’re now officially into crypto!

Selling your crypto is just as easy as buying it. All you have to do is:

1. Tap Crypto on the PayMaya homepage.

2. Tap Sell on the bottom of the screen, then select the desired cryptocurrency.

3. Select a percentage value to sell a part of your currently owned asset. You will see the equivalent PHP value based on an estimated market price. Then tap Next on the upper right hand of the screen.

4. A Confirm Sale tab will pop up. On this tab, you will see the amount of cryptocurrency you will be selling and the amount of PHP you will be receiving through this transaction. Once you are ok with the details, you may confirm your purchase and slide to sell.

You will automatically receive your earnings on your PayMaya wallet. Simply go to your app’s home screen and check the amount. Once you receive the amount, you can choose to use it for your everyday transactions with PayMaya or transfer it to your bank account instantly.

With this seamless experience, PayMaya encourages more Filipinos to experience crypto.

PayMaya is the only end-to-end digital payments ecosystem enabler in the Philippines, with platforms and services that cut across consumers, merchants, communities, and government. It provides more than 41 million Filipinos access to financial services through its consumer platforms. Its Smart Padala by PayMaya network of over 60,000 partner agent touchpoints serves as last-mile digital financial hubs in communities, providing the unbanked and underserved access to digital services.

Through its enterprise business, it is the largest digital payments processor for key industries in the country, including “every day” merchants such as the largest retail, food, gas, and eCommerce merchants, as well as government agencies and units.

1 Comment

Thanks for sharing this informative and well-structured blog post. The topic you covered is relevant, and your explanations were clear and concise. To delve deeper into this subject, click here. Well done!