New data released by Kaspersky showed that phishing detections in local e-commerce and banking sectors doubled in the second quarter of 2022, compared to the first three months of the year.

Phishing is a type of Internet fraud that seeks to acquire a user’s credentials by deception. It includes stealing of passwords, credit card numbers, bank account details, and other confidential information. Phishing messages usually take the form of fake notifications from providers, e-payment systems, banks, and other organizations.

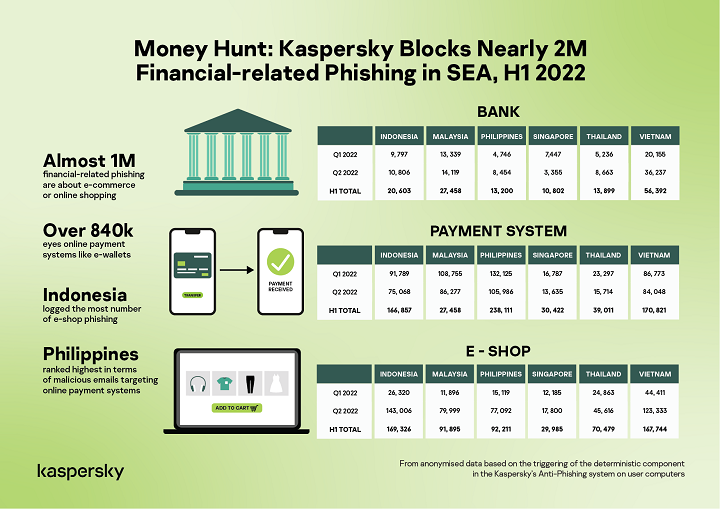

The cybersecurity company recorded 77,092 phishing incidents in Q2 among its e-shop customers in the country from only 15,119 in Q1. This reveals a 409% surge in phishing attempts from April to June this year.

Established data showed the pandemic boosted online shopping in the Philippines. Currently, the top local e-commerce platforms are enjoying brisk sales of beauty, electronics, fashion, furniture, health, and household care products.

These data are anonymized data based on the triggering of the deterministic component in Kaspersky’s Anti-Phishing system on user computers. The component detects all pages with phishing content that the user has tried to open by following a link in an e-mail message or on the web, as long as links to these pages are present in the Kaspersky database.

The rise in the percentage of phishing detections in its e-commerce industry puts the Philippines in third place among its Southeast Asian neighbors next to Malaysia (572.48%) and Indonesia (443.33%).

Meanwhile, among its local bank customers, Kaspersky shared that 8,454 phishing incidents were recorded in Q2 up from 4,746 detections in Q1, or a 78% increase within the first half of the year. The rise in global detections for the same period is only at 28%.

From the same report, phishing attacks against Philippine-based payment systems went down at -19%. There were 132,125 detected phishing attempts in Q1 among Kaspersky users in the payment system sector. Three months later, it trickled down to 105,986 incidents.

The decline in local numbers is relatively similar to the global trend for the same duration at -31.58%. In the payment system sector, all countries in the SEA region showed a decrease in phishing attacks in varying degrees with the Philippines in the third spot trailing behind Thailand (-32.54%) and Malaysia (-20.66%).

“The first half of the year witnessed the reopening of borders in Southeast Asia but the pandemic habits seem to remain consistent. Despite our regained physical freedom, we know that we still prefer to do our banking, shopping, and financial activities online because of its unparalleled convenience,” said Yeo Siang Tiong, General Manager for Southeast Asia at Kaspersky.

“Regulators and industry players in the region are all backing a digital-forward Southeast Asia. In fact, countries here are poised to link their QR code payment systems before the year ends to remove currency exchange hassles. It is a welcome development with possible great economic gains, for us and the cybercriminals. With most users here aware of the threats targeting our online money, it is time to act now and secure your mobile devices to enjoy the perks of a more connected, regional financial environment,” adds Yeo.

Here are tips from Kaspersky on how to stay safe online from phishing attempts:

- Always keep a keen eye on suspicious emails. If it looks too good to be true, check, double-check, and triple-check.

- Maintain two email addresses if you are using free accounts. One is for official use and the other is for websites that require you to log in to read the news or gather information.

- Not all smartphones are secure so be careful of messages that will lead you to a website. There are a number of malicious software that can gain entry into your contacts list and financial apps.

- Use a reliable security solution with anti-phishing and secure payment capabilities like Kaspersky Total Security.

- Still, the best defense to phishing is being informed and discerning of the emails and other messages users receive. There is no harm in being too cautious, especially since most of the financial transactions are now done online in pursuit of digitalization.

Kaspersky products for consumers can be purchased from https://www.kasperskyph.com/, the online shop of iSecure Networks, Kaspersky’s distributor in the Philippines.