The Philippines’ leading fintech super app, GCash, believes prioritizing customer experience is crucial for startups that are looking at achieving the much-coveted ‘unicorn’ status.

A unicorn is a startup that’s valued at over $1 billion dollars, and as for Mynt, the operator of GCash, it’s already achieved double unicorn status in the past year.

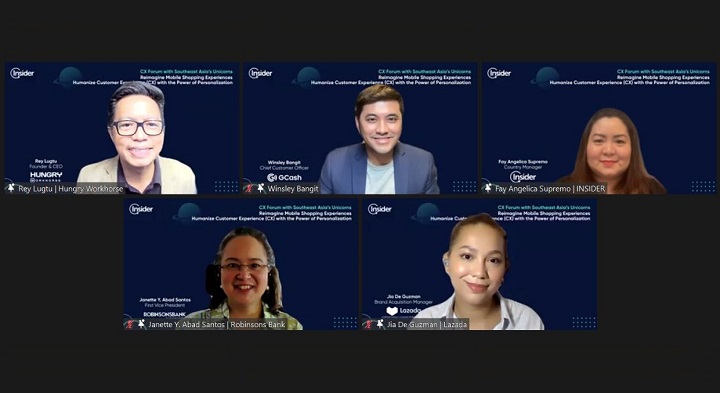

At a recent virtual forum, GCash Chief Customer Officer, Winsley Bangit said that it’s essential to integrate customer feedback and needs when it comes to developing insight-driven customer experiences.

“For any technology app, customer experience is our bread and butter. We need to deliver our promise of convenience, reliability, and safety so that customers can do their financial essentials with peace of mind,” said Bangit.

Bangit also noted that GCash is driven to respond to its users’ needs quickly. For instance, sending money needs to happen in real time, credit needs to be accepted by merchants, and savings should be transparent and easily accessible. However, in the event that a product or service experiences roadblocks, Bangit also assured users that they will quickly react and solve these problems.

Winsley joined several other executives from other companies in a recent virtual forum titled, “Reimagine Mobile Shopping Experiences: Humanize Customer Experience (CX) with the Power of Personalization.” There they discussed how businesses can improve customer experience and how this has become an important driver for successful startups. Aside from Bangit, officials from select Southeast Asian unicorns and companies joined the panel discussion namely, Robinsons Bank Vice President Janette Abad Santos, Insider Country Manager Fay Angelica Supremo, and .

To serve its customers better, GCash also aims to be agile to improve the customer experience with technology. Bangit mentioned that GCash rolled out a verification tool to help ensure that users are certain about who they’re sending their money to and that they will be notified before accidentally sending money to a non-GCash user.

GCash went a step further by ensuring that its subscribers’ money that was being sent to non-GCash users can still be used through GCash Padala. Through GCash Padala, the receiver can collect the money in any of GCash’s 17,000 partner branches nationwide.

As part of its commitment to continuously improve customer experience, GCash builds the trust of its users by safeguarding their security and data privacy. GCash has continuously been rolling out security features such as Personal Identification Number (PIN) verification, facial recognition, One-Time Password (OTP), and electronic Know Your Customer (eKYC) verification process.

“Agility is important in order to quickly respond to our customers’ needs. But more than that, we should be able to hand-hold our customers in their journey as we want to be more than just an app, but to be truly a partner to our customers,” said Bangit.

With over 60 million users to date, GCash ensures that it will continue to be agile in making Filipinos’ everyday lives better and help achieve the company’s vision of enabling a cashless society leading to Finance for All.