UBX, the leading open finance platform in the Philippines, is enabling more than half a million overseas Filipinos in Singapore to make digital cross-border remittances through its widest network of access points at more affordable rates.

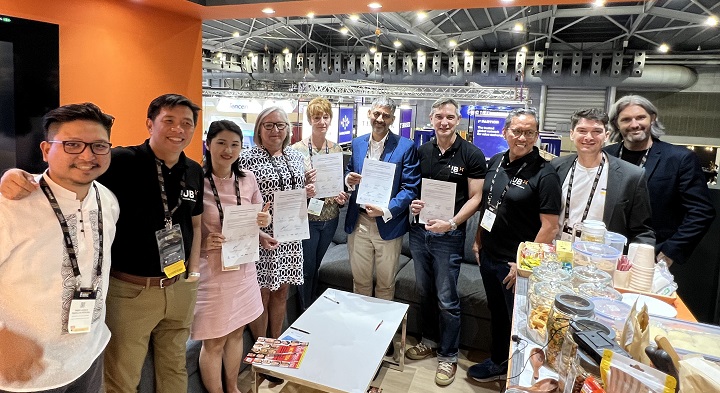

Through a partnership with ThitsaWorks, a fintech backed by the Monetary Authority of Singapore, UBX will provide the necessary digital infrastructure for international remittances between Singapore and the Philippines via its banking-as-a-service venture i2i.

While many remittance options exist for overseas migrant workers in Singapore, options to reach rural areas where many workers’ families live are complicated, expensive, and slow.

Additionally, friends and family who only have accounts with microfinance institutions (MFIs) and rural banks cannot receive direct payments.

With its strategic partnership with ThitsaWorks, i2i aims to connect small financial institutions to real-time payment networks to enable fast, convenient, and ubiquitous cross-border remittances.

This means that overseas Filipinos in Singapore may use the service to send money to any monetary account in the Philippines, regardless of bank, financial institution, or even cash agents under the i2i network.

UBX has the widest network of access points in the Philippines, having partnered with banks, non-banks, financial institutions, e-wallets, and even cash agents to reach the underbanked and the unbanked.

“This is the big step forward to enable fast, convenient, and ubiquitous cross-border remittances for the benefits of the Filipino migrant workers in Singapore. I am confident that this partnership will also accelerate financial inclusion in the Philippines by giving clients across all regions of the archipelago – regardless of how rural or remote – access to secure and connected payments through any financial service provider including rural banks, cooperatives and other community based financial institutions,” UBX President and CEO John Januszczak said.

The Monetary Authority of Singapore recently awarded ThitsaWorks the Financial Sector Technology and Innovation (FSTI) Proof of Concept (POC) grant for the Inclusive Cross-Border Remittances Project.

“We are happy to be a part of the Inclusive Cross-Border Remittance Project which will make remittance cheaper and faster for the Singapore-to-Philippines corridor. I believe this project will positively affect the remittance challenges that many overseas migrant workers in Singapore undergo, which we witness daily. Our ThitsaWorks team is also very excited to work closely with prominent financial industry participants and learn from each other,” Nyi Nyein Aye, CEO and Co-founder of ThitsaWorks, said.

The commercial operations of the pilot program is set for the first quarter of 2023. There are roughly 600,000 overseas Filipinos in Singapore remitting roughly SGD2.8 billion annually.

“We see this as making a material impact on the ability for all Filipinos to participate in the digital economy,” Januszczak said.