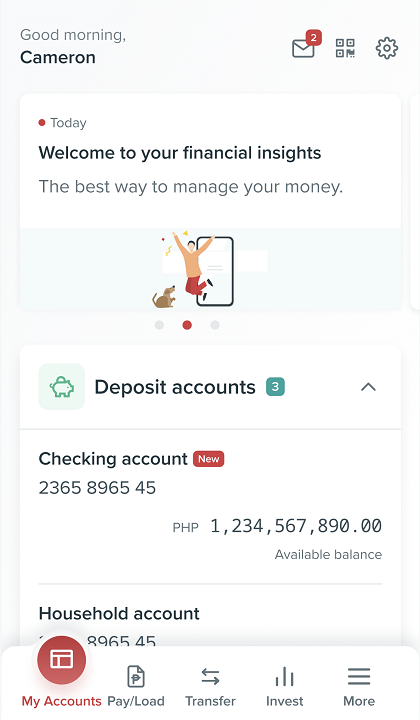

The Bank of the Philippine Islands rolled out its first-in-the-industry feature on the new BPI app. Aptly called Track and Plan, this tool utilizes AI to track and analyze your financial activities on the BPI app, share insights on your spending habits, and even offer suggestions for smarter financial investments—so you can plan for your future.

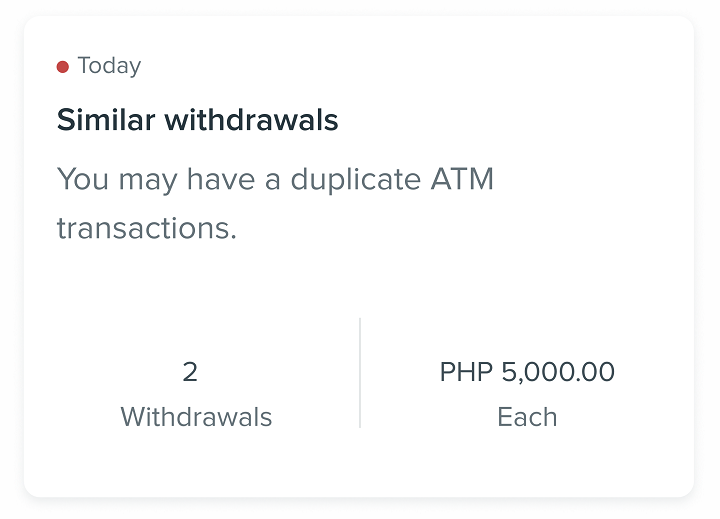

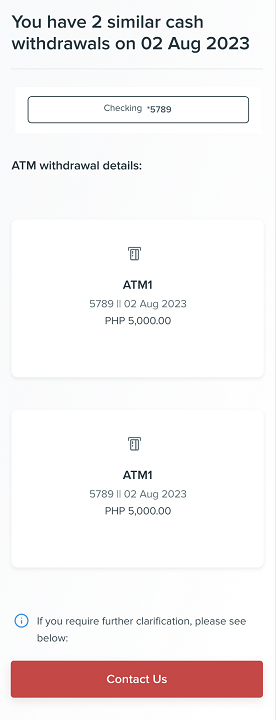

You may have already seen it when you logged on to your BPI app. It’s the animated scrolling cards at the top of the screen. Based on your latest transactions, Track and Plan will generate insights around your cashflow and float up snippets to notify you of, say, similar withdrawals made back-to-back.

You can get the full insight with more details when you click on the notification and easily get in touch with BPI if you need to.

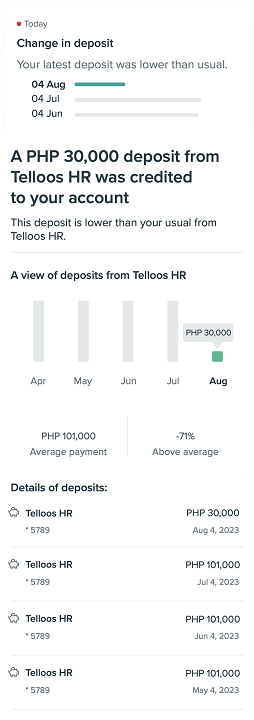

Another insight could be about unexpected changes in deposits from a familiar payor made to your account.

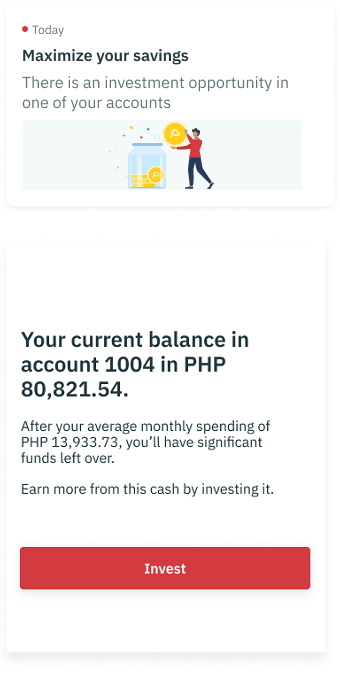

When your balance is consistently high that it sufficiently covers your average monthly expenses, Track and Plan will suggest ways you can invest and grow your extra funds.

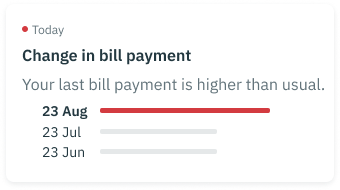

Track and Plan can also monitor trends in your spending and alert you in case your bill is higher than your average—so you can be more mindful of your budget.

This AI-powered tool generates unique insights that only you can view, and you can rest assured about the privacy of your financial transactions. It is the first of its kind in the industry. By design, Track and Plan will continue to give you new insights based on your app usage.

“I have been covering the financial industry for decades and I have never seen a banking app that acts like a financial advisor with powerful access to tools that allow anyone to move from knowledge to action,” says veteran journalist and ‘Financial Beshie ng Bayan’ Salve Duplito. “Let’s face it, most of us get offended when someone tells us we are spending too much, but with Track and Plan, it’s like you telling you! So our emotional human experience gets a big jolt of logic — and that could be transformational in bringing our country’s savings rate higher.”

“We at BPI are excited to unveil Track and Plan, our AI-powered personal finance management tool on the new BPI app,” says Mariana Zobel de Ayala, Consumer Marketing and Platforms Head at BPI. “We are leveraging technology to simplify money management to empower Filipinos to do more and make their lives better every day. This feature essentially scales BPI’s seasoned and personalized financial advice to millions of Filipinos and is the next step forward in BPI’s evolution. Our customers can look forward to more in-depth insights and actionable advice as we continue to develop this feature.”

As AI learns from patterns or features in data, insights from Track and Plan gets better the more you use it. BPI will also be expanding its capabilities in the coming months so users will eventually have the option to turn on automatic monthly investments, schedule their most frequent transactions, and best of all, stay on top of their spending and earnings with a built-in budget tracker. All these will be available exclusively on the new BPI app.

Time to “move app,” don’t you think?