With the holidays just around the corner, many small business owners are looking forward to seeing a rise in their revenue. In fact, in the US, there has been a clear trend of people turning to pawnshops at the end of the year to get extra cash for their Christmas spending. However, even small business owners must deal with seasonal financing challenges to cope with increased demand and costs.

In the Philippines, businesses are required to provide 13th month pay, which means small business owners must manage their cash flow well and find immediate financing to succeed. For small businesses that need money quickly, owners can turn to pawning for quick and flexible financing during this time. Here are some reasons why pawning can be a viable financing option for small business owners this holiday season:

Pawning provides quick access to cash. Unlike bank loans that may take weeks to get approval for, pawnshops can offer fast and easy access to cash, with most even getting approved within the day. Such quick timing can be crucial for small businesses that need immediate funds to keep up with the increased demand and costs of the busy holiday season.

Pawning does not require a credit history. Credit history is an important part of most banks’ loan application process. Without a credit history, a borrower has little to no chance of getting approved for a bank loan. PawnHero — a BSP-regulated online pawn shop — takes a different approach. With PawnHero, all you need is proof of income to use their services. As for the loan amount, it’s based on the value of the item to be pawned. This makes it easier for borrowers, especially small business owners, to have cash on hand instantly.

Pawning has lower interest rates than bank loans. In contrast to banks’ interest rates, pawnshop interest rates are often lower and friendlier to borrowers, making them a more affordable option for small businesses. In April 2023, the average interest rate for bank loans was 7.29%. On the other hand, PawnHero, an online pawnshop in the Philippines, provides one of the lowest interest rates in the country, starting as low as 3.5% per month.

Pawning offers flexible loan terms. Pawnshops offer a variety of loan terms from short- to long-term, which lets business owners choose a repayment plan according to their needs and budget. For example, pawning tickets typically have a duration of 30 to 120 days, but they may be renewed if needed. Combined with lower interest rates, pawning is definitely a more practical financing option for small business owners.

Pawning has no prepayment penalties. When banks offer loans, their payment terms are often set in stone, which means borrowers can’t pay in advance, even if they wish to, because they might incur prepayment penalty fees. In contrast, pawnshops do not charge such penalties, so business owners can repay their loans early without any penalty fees. So if revenue surges and investment returns quickly during the holiday season, small business owners can also pay off their loans immediately if they want to.

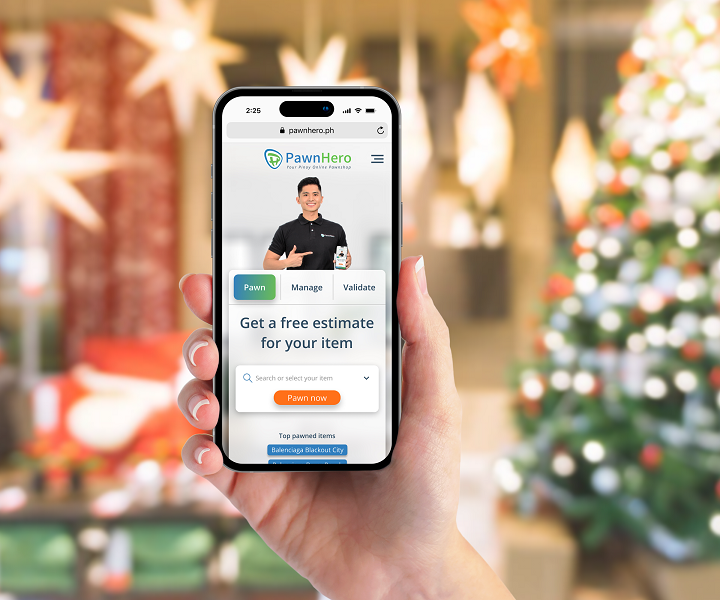

You don’t have to leave the comfort of your home to pawn. Unlike traditional brick-and-mortar pawnshops, PawnHero offers an online platform that allows customers to pawn their items from home. The convenience of accessing PawnHero’s services anywhere, anytime, makes it a pawn shop like no other.

During the busy holiday season, every minute counts when it comes to managing your small business. That’s why PawnHero is here to help you save valuable time and effort. With PawnHero, you just need to take photos of your items, have them appraised online, wait for quick approval, and schedule your item for free pickup. Once PawnHero receives your item, you can instantly receive your cash through your bank account — ready for your small business’s needs this holiday season!