ubx

ubx

UBX, the leading open finance platform in the Philippines, has delivered its open ecosystem for decentralized identity management called AKIN to provide individuals with full control over their personal information, allowing them to transact freely and securely through one digital identity.

AKIN realizes the concept of self-sovereign identity (SSI) – a digital movement that recognizes an individual’s power to own and control his or her identity without any intervening administrative authorities. SSI allows people to interact in the digital world with the same freedom and capacity for trust as they do in the offline world.

SSI allows users to manage their own information and decide who gets access, anytime, anywhere. This shifts identity and credential management from the client-server model to a peer-to-peer model.

In layman’s terms, SSI provides individuals more control over their data, allowing them to choose companies or entities or individuals that can use their data.

For instance, a customer with an SSI processed through a partner bank can use their existing SSI to apply for a postpaid line with a local telco, removing the need to fill out forms and reducing friction and duplication inherent in companies’ know-your-customer (KYC) process.

By streamlining the users’ information and simplifying transactions, AKIN complements the Philippine Identification System (PhilSys), a project of the Philippine government. According to Republic Act No. 11055, PhilSys is also motivated by financial inclusion, the same goal which is at the heart of every endeavor by UBX.

The primacy of sovereignty is also present in the national ID or the Philippine Identification ID (PhilID). PhilSys will give users the ability to determine who sees their data when transacting using Philsys.

“Coopetition, a play on cooperation and competition, is one of the central principles of AKIN. In other words, AKIN encourages institutions to cooperate with each other in the development and operation of the technical system, which would lead to a healthy competition in the development of new products and services based on it,” said UBX President and CEO John Januszczak.

Much like the PhilID, AKIN is expected to enhance the integrity of services and reduce fraud because it uniquely identifies each registered person according to a given set of data, making it difficult for others to gain access to the same set of credentials.

“Now that we are in the digital age, our first and foremost priority is the data security of customers. As the country’s leading open finance platform, we ensure full compliance with the data regulation statutes as well as with the rules promulgated by various financial institutions and service providers,” Januszczak explained.

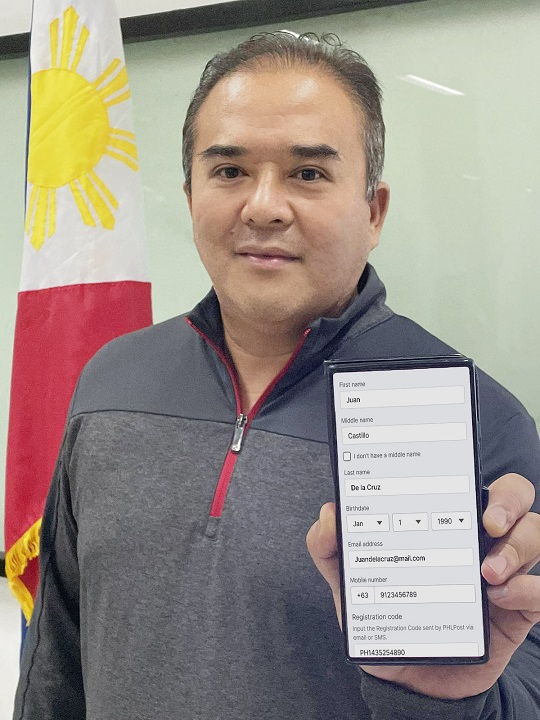

The Philippine Postal Corporation (PhilPost) is one of the first organizations integrating AKIN into its system. Through its partnership with GRP Mobile Solutions Inc. and UBX, PhilPost is developing a mobile app that will feature digital financial solutions that will complement its existing postal services.

“As part of our innovation efforts and digitalization initiatives comparable to the best postal service in the world, we are proud to partner with UBX, the leading open finance platform in the Philippines as well as GRP Mobile Solutions Inc. for our PHLPost App. This is part of our bid to not only improve our postal services, but to also promote financial and social inclusion. Integrating AKIN into our mobile app, which will be launched within the year, enables our users to further leverage open finance solutions that fit their needs,” Postmaster General Norman Fulgencio said.

With AKIN, users can digitize cards in their respective wallets to identify themselves online. By simply downloading one of the partner wallet apps to their mobile phones, they can receive, store, and manage their data accordingly.

Security is ensured through encryption to prevent third parties from creating bogus user profiles. Since the wallet serves as an all-around platform where people can manage their personal data, transparency is guaranteed not just to customers but to companies and institutions as well.

“This digital transformation powered by UBX allows us to truly elevate the Filipino standard of living beyond just the digitization of finance. UBX constantly innovates to assist the public sector in providing quality services for all. With AKIN, we are definitely several steps closer to achieving true financial inclusion as we accelerate towards a digital economy,” Januszczak said.