Proving its status anew as an industry trailblazer, Union Bank of the Philippines (UnionBank) recently achieved another first in the industry after securing a Certificate of Authority from the Bangko Sentral ng Pilipinas (BSP) to operate as a virtual asset service provider (VASP), making it the first and only universal bank in the Philippines to offer virtual asset exchange services.

With the full VASP license from the BSP, the Bank can now extend virtual asset exchange services to a broader base of UnionBank customers through the award-winning UnionBank Online app. These virtual asset exchange services previously were accessible only to randomly selected users of the app through a limited virtual asset license.

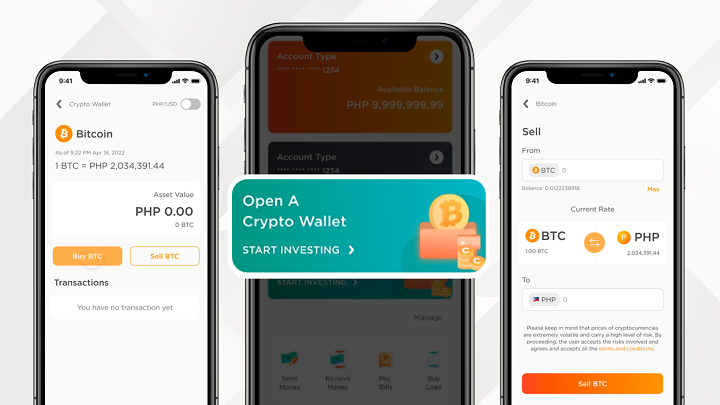

The new feature, set to roll out gradually in the final quarter of 2023, will now enable UnionBank customers to directly buy and sell Bitcoin (BTC) through the app, providing a convenient and secure platform for trading cryptocurrencies through a well-established and trusted financial institution. This will also allow them to manage both traditional banking and digital assets within a single mobile platform.

“In this era where change is constant, our pursuit of this license isn’t just about staying current, but about being future-proof and future-ready. The financial landscape is evolving at an unprecedented pace, and we want to be at the forefront, ensuring that we are equipped to meet the evolving needs of our clients,” said UnionBank SVP and Head of Emerging Technology Group Cathy Casas.

“Our commitment to our clients is the driving force behind every innovation we introduce,” said UnionBank EVP and Chief Technology and Operations Officer Dennis Omila. “Through these new services, we are empowering them to be able to navigate this new space with confidence.”

“This milestone represents a significant leap forward for UnionBank as we continue to revolutionize the banking landscape. By obtaining this license, we are not only paving the way for even more groundbreaking opportunities, but also enhancing our digital capabilities and further transforming the way our customers interact with us,” said UnionBank President and CEO Edwin Bautista.

The adoption of blockchain technology has been integral to UnionBank’s future-proofing strategy, and the Bank has been actively exploring potential use cases, including cryptocurrencies, to adapt to evolving customer needs and financial trends. For instance, in 2019, the Bank launched the country’s first bank-operated, two-way virtual currency ATM located in its digital branch “The ARK” in Makati City, which allows users to buy and sell cryptocurrencies.

The initiative aligns with the Bank’s “Tech-Up Pilipinas” advocacy, aimed at advancing digital literacy among Filipinos and enhancing financial inclusion and technological empowerment in the country.