To help bridge the priority and protection gap in the country, FWD Life Insurance (FWD Philippines) introduces SmartStart Investment-linked Insurance—the insurance plan for everyone.

According to a comprehensive online study conducted by FWD Philippines, the majority of Gen Zs (85%) agree that owning an insurance is important and is something they need. However, while most (73%) have an intent to protect themselves, only 3 out of 10 own life insurance. This highlights a priority gap as they choose to spend on other essentials first.

This is further aggravated by the next generation’s lack of awareness and understanding on how insurance products and services work, which leads to the Philippines having one of the lowest insurance penetration rates in the region at less than 2%.

“As the insurer of the next generation, providing innovative, inclusive, customer-centric products to more Filipinos has been our priority as part of our nation-building efforts,” explains FWD Philippines President and CEO, Antonio Manuel “Jumbing” De Rosas. “In celebration of our 10th anniversary and to continue our commitment in changing the way young people feel about insurance, we designed a trailblazing product to align with the youth’s behavior to spend on their passions while maximizing value— helping them to celebrate living and build their best future.”

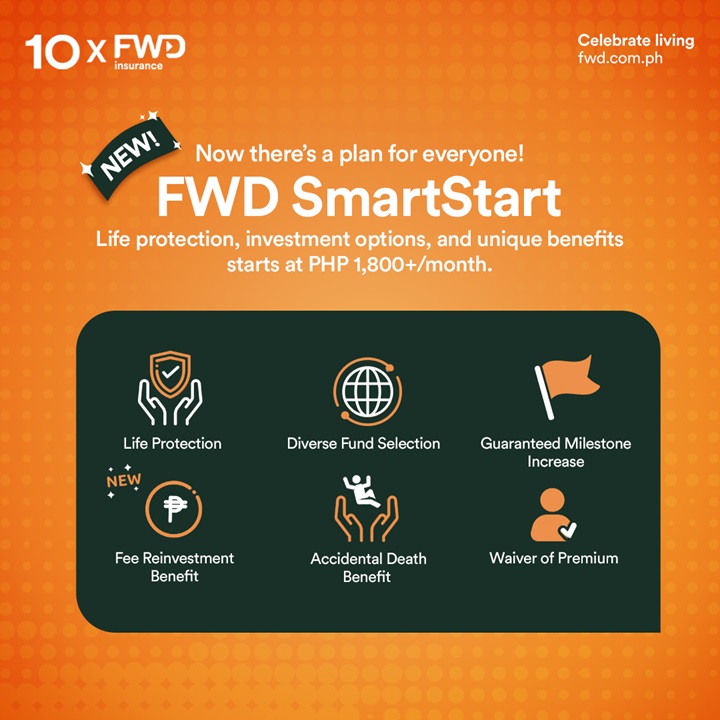

FWD SmartStart Investment-linked Insurance is one of the most affordable entry-level insurance products in the market. SmartStart is perfect for active hustlers with a FIRE (Financial Independence, Retire Early) mindset—these are people who have no dependents, are investing in their passions, and are looking to diversify their finances. Starting at PhP1,800+ per month, benefits include accidental death coverage, waiver of premium, and investment options. Policyholders also have add-on benefit options for life insurance, hospital cash benefit, and critical illness coverage.

For those with limited budget, there is also SmartStart Lite, perfect for breadwinners who are looking to get their first insurance to help them raise a family or even support their parents. Starting at PhP1,200+ monthly, policyholders can sustain their responsibilities and keep it within their budget while getting comprehensive coverage for accidental death and critical illness plus a waiver of premium. Life insurance and hospital cash benefits can also be availed as add-on benefits.

Additionally, policyholders can enjoy the Guaranteed Milestone Increase Benefit, which offers a pre-approved one-time increase in coverage amount when they hit major life milestones— from getting married, having or adopting a baby, owning a new real estate, graduating from university, retiring, to celebrating their policy’s 10th anniversary. Furthermore, customers can get as much as 200% of their policy fees back as a reward for keeping their policy active and paid through the Fee Reinvestment Benefit.

SmartStart was launched alongside The One for mental wellbeing, which is a fully customizable life insurance policy that provides special access to certified mental health professionals via ThoughtFull mobile app. Both products were introduced as part of FWD’s 10th anniversary celebrations since establishing roots in the Philippines in 2014.

Celebrate living today and thank yourself later with FWD SmartStart Investment-linked Insurance.

6 Comments

Your style of writing is quite appealing. It is indeed a pleasure to encounter such well-constructed blogs that manage to achieve such a wonderful combination of simplicity and detail. Well done! lmc 8.4

Immerse yourself in the excitement of Slot Heaven, a place where you will find endless entertainment. With such a huge selection of slot machines, it is guaranteed that you will find the perfect match for your preferences among over 16,000 choices. It does not matter if you consider yourself a novice or seasoned veteran of slot machines, here you will find high RTP precious percentage, amazing bonus enhancements and safe gambling environment. Get ready to explore the world of slots like you have never done before. Dare to join the Slot Heaven challenge? It’s time to transform your online gambling experience! 슬롯천국

Useful info. Fortunate me I discovered your web site by accident, and I’m surprised why this coincidence did not came about earlier! I bookmarked it. chochox

I didn’t realize that the interface of GBWhatsApp was THAT simple to understand. Im not sure but maybe there are people here who already did and can help us along the way? Download GB WhatsApp

This is a well-thought-out article from a true writer. I agree with numerous strong points made. Excited to see what’s next! Fute max

It’s difficult to acquire knowledgeable folks within this topic, however you be understood as there’s more you are discussing! Thanks noodle magazine