Xiaomi Corporation (“Xiaomi” or the “Group”; stock code:1810), a consumer electronics and smart manufacturing company with smartphones and smart hardware connected by an Internet of Things (“IoT”) platform at its core, announced its unaudited consolidated results for the three months ended September 30, 2023 (“2024 Q3” or “the Period”). The revenue for the Period reached a new record high, marking a third consecutive quarter of robust growth. In Q3 2024, revenue reached RMB92.5 billion, representing a year-over-year (“YoY”) increase of 30.5%. Adjusted net profit reached RMB6.3 billion, maintaining historically high levels. The premiumization strategy made significant strides, with the overall gross profit margin at 20.4%, remaining elevated. Xiaomi’s three core businesses – smartphones, IoT and lifestyle products, and internet services – achieved revenues of RMB47.5 billion, RMB26.1 billion, and RMB8.5 billion, respectively. Revenue from the smart Electric Vehicle (“EV”) and other new initiatives business reached RMB9.7 billion, nearing the RMB10 billion milestone, with overall performance exceeding expectations. The growth underscores Xiaomi’s “Human x Car x Home” smart ecosystem as a new growth engine, driving the Group to achieve record results.

In Q3, Xiaomi’s cash resources continue to exhibit an upward trend, reaching a new high of RMB151.6 billion as of September 30, 2024. During this year’s Double 11 shopping festival, Xiaomi’s omnichannel cumulative gross merchandise value (“GMV”) surpassed RMB31.9 billion, reaching a record high. As its business segments thrive, Xiaomi has strengthened its competitive edge, embarking on a new development stage.

Xiaomi’s smartphone market share in mainland China up for third consecutive quarter; while Xiaomi 15 Series sales top 1 million units

Xiaomi’s global smartphone shipments reached 43.1 million units in Q3, up 3.1% YoY. According to Canalys, Xiaomi’s global smartphone shipments ranked among the top three smartphone brands globally for the 17th consecutive quarter, with a market share of 13.8%. In particular, Xiaomi’s smartphone shipment ranking in mainland China rose to No. 4, with its market share increasing by 1.2 percentage points YoY to 14.7%, marking three consecutive quarters of market share growth.

In Q3, Xiaomi’s smartphone revenue reached RMB47.5 billion, an increase of 13.9% YoY. It continued to make significant progress in its smartphone premiumization strategy. According to third-party data, Xiaomi’s smartphones priced at RMB3,000 and above accounted for 20.1% of total smartphone shipments in mainland China, representing an increase of 7.9 percentage points YoY. By price segment, Xiaomi achieved YoY increases in market share across three smartphone price segments in mainland China in 2024 Q3. In the RMB3,000 – 4,000 segment, Xiaomi’s market share reached 18.1%, up 9.3 percentage points YoY. In the RMB4,000 – 5,000 segment, Xiaomi’s market share reached 22.6%, up 9.7 percentage points YoY. In the RMB5,000 – 6,000 segment, Xiaomi’s market share reached 6.9%, up 2.4 percentage points YoY.

Xiaomi’s premium smartphone lineup continues to exhibit robust growth, with the Xiaomi 15 Series achieved 1 million unit sales volume faster than the previous generation. Since its debut, the series has consistently been a bestseller, setting new records for initial sales of flagship smartphones. During the 2024 Double 11 shopping festival, it led both sales volume and revenue across mainstream e-commerce platforms in the RMB4,000 – 5,999 price segment.

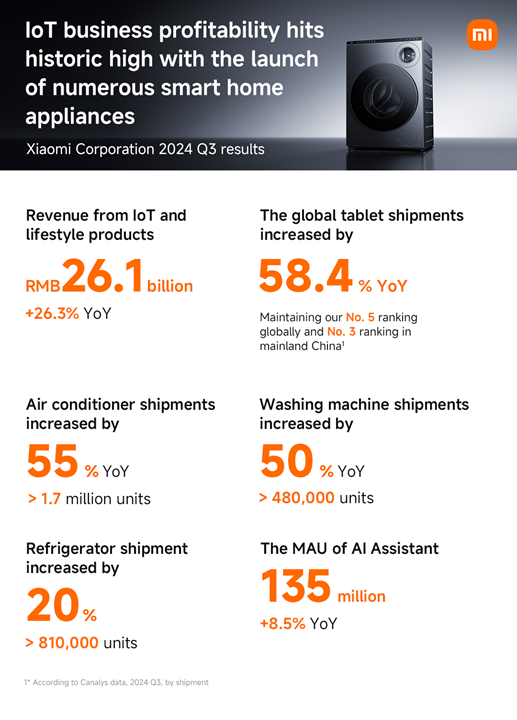

IoT business gross profit margin reaches a new high, with air conditioner and washing machine shipments growing by over 50%

Xiaomi IoT and lifestyle products business maintained its strong growth momentum in Q3, with its revenue reaching RMB26.1 billion, up 26.3% YoY and gross profit margin reaching a record high of 20.8%, up by 2.9 percentage points YoY.

Leveraging proprietary technology to develop innovative products, Xiaomi’s IoT ecosystem achieved growth in both volume and value. Shipments of both refrigerators and washing machines reached record highs, with air conditioner shipments exceeding 1.7 million units, up over 55% YoY; refrigerator shipments surpassed 810,000 units, up over 20% YoY; and washing machine shipments exceeded 480,000 units, up over 50% YoY.

According to Canalys, Xiaomi’s global tablet shipment continued to achieve rapid growth, maintaining No. 5 ranking globally and No. 3 ranking in mainland China. The shipment of Xiaomi’s global wearable products increased by over 50% YoY, and both its smartwatch and TWS earbuds shipments reached record highs.

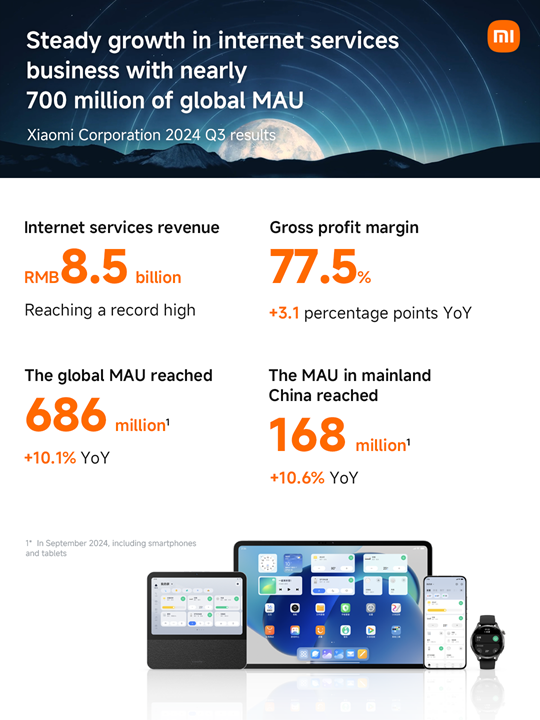

Internet services revenue hits new high with gross margin remaining elevated

During the Period, the internet services business continued its rapid growth, with revenue increasing by 9.1% YoY to RMB8.5 billion, reaching a record high. The gross profit margin of the internet services reached 77.5%, an increase of 3.1 percentage points YoY.

Xiaomi’s internet user base continued to expand. The MAU globally and in mainland China both hit record highs. In September 2024, the global MAU reached 685.8 million, an increase of 10.1% YoY, while the MAU in mainland China reached 167.9 million, up 10.6% YoY.

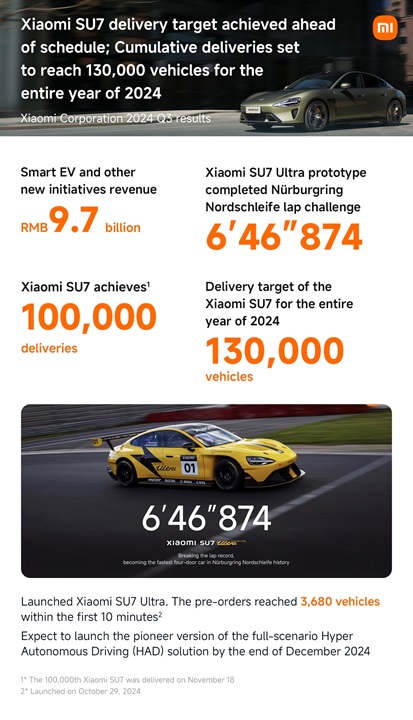

Xiaomi SU7 achieved delivery target of 100,000 vehicles with smart EV revenue nears RMB10 billion

Xiaomi EV has once again achieved growth beyond expectations. In 2024 Q3, revenue from smart EV and other new initiatives business reached RMB9.7 billion, approaching the RMB10 billion milestone, with the business gross profit margin rising to 17.1%. Xiaomi continued to ramp up production, with the deliveries of the Xiaomi SU7 Series reaching 39,790 vehicles in the quarter. As of September 30, 2024, Xiaomi delivered 67,157 vehicles of the Xiaomi SU7 Series.

In October 2024, the monthly deliveries of the Xiaomi SU7 Series exceeded 20,000 vehicles. Moreover, Xiaomi achieved a cumulative production of 100,000 vehicles on November 13, 2024 and the delivery target of 100,000 vehicles on November 18, 2024. Xiaomi will strive to achieve the delivering of 130,000 vehicles for the entire year of 2024. Xiaomi’s sales and service network is also rapidly expanding, with 127 smart EV sales centres across 38 cities in mainland China as of September 30, 2024, driving the Group to speed up the delivery.

In October 2024, Xiaomi SU7 Ultra Prototype completed its Nürburgring Nordschleife lap challenge, breaking the record for “The Nürburgring Nordschleife World’s Fastest Four-Door Car” with a time of 6’ 46”874. Pre-orders are now open for the mass-produced Xiaomi SU7 Ultra, which is powered by a tri-motor system consisting of dual proprietary Xiaomi HyperEngine V8s and a Xiaomi HyperEngine V6s. Xiaomi SU7 Ultra reaches a maximum designed speed of 350 km/h. Priced at RMB814,900, the pre-orders of Xiaomi SU7 Ultra reached 3,680 vehicles within the first 10 minutes. The Xiaomi SU7 Ultra is scheduled for official release in March 2025.

Committed to becoming a global leader in the evolving realm of cutting-edge technologies with Increased R&D Investment

Xiaomi is committed to investing sustainably in foundational core technologies and becoming a global leader in the evolving realm of cutting-edge technologies. In 2024 Q3, Xiaomi’s research and development (“R&D”) expenses reached RMB6.0 billion, up 19.9% YoY. As of September 30, 2024, Xiaomi had 20,436 R&D personnel. Xiaomi has obtained more than 41,000 patents worldwide. In 2024, the Group’s ranking in the valid global patent families of declared 5G Standard Essential Patents (“SEPs”) improved to 8th worldwide.

On November 14, 2024, Xiaomi EV unveiled its smart chassis pre-research technology, showcasing four core technologies: Xiaomi Full Active Suspension, Xiaomi Quad-HyperEngine, Xiaomi 48V Electric Mechanical Brake and Xiaomi 48V SbW System. Additionally, Xiaomi’s smart driving system will fully embrace the end-to-end large model and rebranded as HAD, with the pioneer version of the product set for launch by the end of December 2024. To date, Xiaomi’s smart driving system has covered over 75 million kilometers, with NOA accounting for 81% of this distance, spanning 333 cities nationwide with the presence of Xiaomi SU7. This demonstrates Xiaomi’s significant advancements in the smart driving sector. Starting October 30, 2024, Xiaomi SU7 Pro and Xiaomi SU7 Max began a phased rollout of the city navigation assistance feature (urban NOA), marking a new phase for Xiaomi’s smart driving.

In October 2024, Xiaomi officially launched Xiaomi HyperOS 2, marking a significant step towards building a comprehensive AI ecosystem. It features three core technological innovations – HyperCore, HyperConnect, and HyperAI – offering a fresh and advanced experience for global users in fundamental functionality, cross-device smart connectivity, and AI interactions.