Amdocs (NASDAQ: DOX), a leading provider of software and services to communications and media companies, reveals the findings of an extensive study of the over-the-top (OTT) media service markets in the Philippines and other emerging and advanced markets in the Asia Pacific.

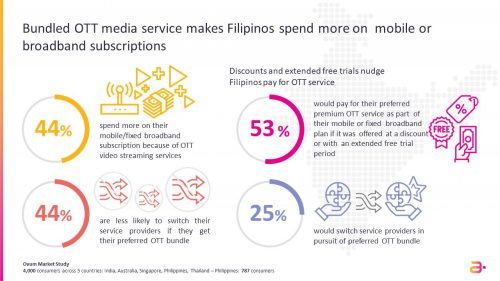

According to the survey, Filipino subscribers of carrier-bundled OTT media services spend more when the offerings are bundled as part of a mobile or home broadband package. These same consumers are also among the most likely to remain loyal if provided with the right media offer.

The results, which reflect consumer sentiments shortly before the COVID-19 pandemic, remain even more relevant in today’s context given the rise in OTT content consumption. The survey also found that Filipinos are some of the most avid users of OTT media services, concluding that the percentage of people subscribing to paid OTT services would grow dramatically if they were made more affordable and accessible through bundling and innovative pricing models.

Conducted by analyst and consultancy firm Ovum on behalf of Amdocs, the study surveyed more than 4,000 consumers in five emerging and developed countries in the Asia Pacific, with over 20 percent of the respondents coming from the Philippines. Other countries surveyed are India, Thailand, Australia and Singapore. The research also included qualitative conversations with 13 communications service providers and 12 OTT media players in the region.

“The OTT streaming market in Southeast Asia, including the Philippines, is heating up, with the Tencent and IQiyi faceoff against Netflix and Disney adding further intensity,” said Guillermo Escofet, principal analyst at Ovum (Omdia). “With COVID-19 slowing down the economy and negatively impacting incomes, however, carrier-bundled services offer the best opportunity for OTT players to grow their market. We believe that if service providers can quickly innovate with their pricing models and rapidly add more OTT partners to their tariff bundles, they will come out as clear winners.”

Key findings in the Philippines:

- Carrier-bundled media services drive consumers to spend more and maintain loyalty: Forty-four percent of Filipino respondents said bundling media services with their telecom plan was the main reason they were willing to spend more on their mobile and fixed broadband subscriptions. A similar percentage (44%) said access to such a service made them less likely to switch providers, while 25 percent said they might switch in the absence of attractive bundled offers.

- Filipinos are some of the most avid consumers of paid online video despite the Philippines having the most nonbundlers out of the emerging markets in the study: Interestingly, 55 percent have access to or are subscribed to paid OTT services. Only half, however, were subscribed to a bundled media service. The survey also found that discounts and free trials can hook more consumers: 53 percent are willing to pay for premium media services via their carrier bill if offered a discount or an extended free trial – but only if offered by their existing provider.

- OTT services remain expensive for most Filipinos; pay-per-use and advertising model are more promising than monthly subscriptions: The average online video subscription (₱242) is too expensive for nearly 51 percent of consumers. The maximum consumers would willingly pay for a monthly online video subscription is: ₱50-₱150 (17%); ₱151-₱300 (28%); ₱301-₱450 (21%); ₱451-₱600 (16%); ₱800+ (11%). The unaffordability of paid OTT subscriptions may worsen as COVID-19 impacts the economy and individual incomes. Seventy-two percent of Filipinos would purchase a one-time pass for specific content or short-term access to content to avoid paying for a full subscription. Furthermore, Filipinos would willingly share personal data and do not mind ads in return for a discount. Seventy-five percent of Filipinos are okay with ads if they bring the cost of OTT entertainment down, and 64 percent would share data in order to receive targeted ads.

- Foreign movies and drama series and local content attract most Filipinos: Foreign brands – both regional and global – dominate viewership in the Philippines. Netflix is a clear market leader, followed by iFlix and Fox+.

“Filipinos are some of the most avid consumers of OTT streaming services,” said Jeff Sakkal, GM, head of APAC business, Amdocs. “As our research shows, the right bundle offered at the right price can help service providers not only win more customers but also grow revenue. But to achieve this, they must address OTT partner onboarding and integration challenges and rapidly scale and devise new pricing models for different user segments – all while ensuring a frictionless end-user experience for successful OTT monetization.”