As lending remains to be a concern due to the ongoing COVID-19 pandemic, financial institutions can look at possible solutions by thinking out of the box, going beyond the conventional means to secure potential borrowers’ information. And, use technology to lower the risks of lending.

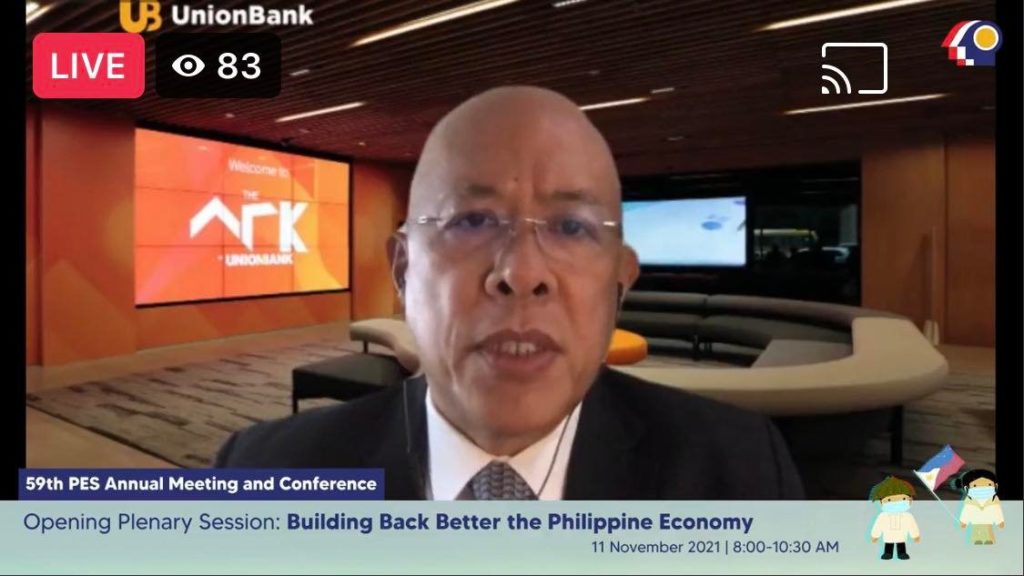

Union Bank of the Philippines (UnionBank) Senior Executive Vice President, Chief Finance Officer & Treasurer, Jose Hilado, expressed this idea as a panelist at the 59th Annual Meeting and Conference of the Philippine Economic Society last month. He was in a session titled “Building Back Better the Philippine Economy” focusing on what stakeholders can do to help rebuild the country’s economy.

Hilado cited credit as one of the key drivers to recovery as it can enable corporates and micro, small, and medium businesses (MSMEs) to resume operations, spurring economic activity. However, he added that given the uncertainties of the pandemic, lending has become challenging.

“Even if we want to lend, the demand is not there. We actually saw our corporate borrowers paying off their long-term loans because rates were now a lot lower. In the areas where you have demand, the credit process is more difficult, for example, the SMEs. While we are being encouraged to lend to the SMEs, it is not easy due to the absence of credit information,” Hilado said.

In July last year, the Bangko Sentral ng Pilipinas enjoined banks to ease their lending processes to facilitate more business borrowings, but the lenders had apprehensions understandably against the backdrop of pandemic. More than a year after, with the country on its way to recovery, financial institutions are still cautious when it comes to lending.

“As banks, we have a responsibility to our depositors and we have to make good credit decisions,” Hilado emphasized. “So, [lending] has become challenging. The market that does not want to borrow, they have the credit information. The market that wants to borrow, it’s hard to execute the lending because of its absence,” Hilado said.

The CFO suggested solutions for lenders. “What the banks should be doing is to experiment with alternative credit information. We have to go beyond the usual process and instead, use alternative credit information such as telco data, transaction history, and social behavior; and then create credit models or algorithms that would predict the probability of clients paying.”

Openness, trust key to improved financial literacy in PH

Meanwhile, UBX President and CEO John Januszczak talked about the fintech company’s and its parent’s UnionBank experience, at the same event during a session on “Harnessing Digitalization for Economic and Financial Literacy.”

“We see huge opportunities to provide access by serving financial services digitally and of course, making a positive and material impact on financial literacy along the way. However, key challenges in technology and digital adoption remain,” Januszczak said.

There are still numerous hurdles to full adoption of digital services even as the pandemic accelerated digital acceptance. These include a lack of understanding of how digital services work, misconceptions related to security, and friction points that make adoption cumbersome for many. UBX has been continuously collaborating with regulators to develop relevant solutions to address these stumbling blocks.

“The market pull of UBX complements the regulatory push by the Central Bank and by the regulators,” Januszczak said. “For example, in working with the BSP, we were able to create a blockchain-based payment network that connected community-based financial service providers—rural banks, thrift banks, etc.—to the larger National Retail Payment System or NRPS.”

UBX contributes to the improvement of financial literacy in the country by providing digital solutions that are simplified. By making services easier to understand and thus, more accessible to the public/ individuals, UBX lowers the barrier to financial literacy. Complementing this is the company’s agnostic mindset that allows it to work with other solutions providers, all in the name of financial literacy and inclusion.

“Among the reasons why we spun ourselves out [of UnionBank] is we want to be open by design. So, we do not discriminate against any reputable financial services provider.” But the most important component to promoting financial literacy, Januszczak adds, is trust. “You have to bake into the activities and experiences that truly matter, and by extension those should be embedded in these digital forms that people implicitly trust.”