SeekCap, an online lending marketplace built by leading open finance platform UBx, gears for a fourfold increase in loans processed in 2022, as it further strengthens its pursuit for partnerships with online communities, platforms, and governments to reach more micro, small and medium enterprises (MSMEs) who need access to business loans.

This optimism comes on the back of SeekCap’s remarkable growth in 2021, when it processed over P6 billion in loans from more than 40,000 MSMEs. This year, SeekCap aims to process roughly P33.5 billion in loans, a target that is 6x higher than the volume last year.

“SeekCap was born out of UBX’s desire to reach MSMEs, who traditionally, have no access to financing to grow their businesses due to the hefty requirements of business banking. We believe that by democratizing access to loans, we will be able to help more growing businesses expand their operations and help in the recovery of the overall economy this year,” UBX Managing Director for Lending Marcy Pilar-Inajada said.

SeekCap leverages its partners’ wide user base to offer loans to businesses. Its partners include leading online marketplace Lazada and online food and grocery delivery platform foodpanda, among many others.

This year, SeekCap plans to partner with more MSME ecosystems, as well as e-commerce, franchising, and wholesale players to further expand its reach.

“The opportunity for SeekCap is huge, given that 99.51 percent of all businesses in the Philippines are MSMEs. Our goal is to reach 100,000 new customers this year or about 10 percent of the total growing businesses in the country,” Pilar-Inajada said.

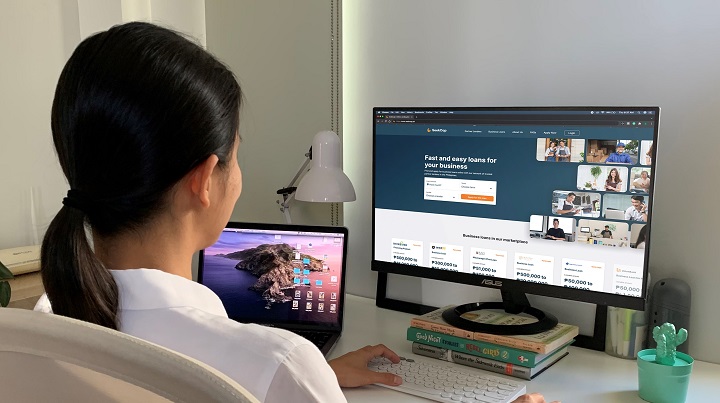

SeekCap simplifies the processing of business loans through its digital platform. Business loans may be processed in as fast as 24 hours, which is significantly faster than the minimum 30-day approval time for most banks.

SeekCap also plans to bring local governments into its end-to-end digital lending platform to encourage their citizens to grow their businesses through financing.

In fact, SeekCap has already been working on this goal for as early as 2020. SeekCap partnered with the local government of Pasig to introduce the Pasig TAPAT (Tulong at Pampuhunang Ayuda sa Taga-Pasig) Business Loan Program.

The program brings lenders and borrowers closer via the SeekCap platform, streamlining the process of getting a business loan while making financing more accessible for small businesses in the city.

“Our strategy is to activate as many channels as we can. With the partnerships with the government, we hope to activate more channels within the different cities and provinces, especially in the far-flung areas where the unserved and underserved are,” Pilar-Inajada said.

8 Comments

thank you for sharing such an informative post! It is good to know about seekcap.

Enjoyed every bit of your post.Really looking forward to read more. Much obliged.

Really informative blog article.Thanks Again. Awesome.

I really liked your blog article.Much thanks again. Great.

wow, awesome blog.Really thank you! Really Great.

Major thankies for the blog post.Really thank you! Much obliged.

Im thankful for the blog post.Thanks Again. Cool.

Pingback: SeekCap seeks to grow 4x in 2022 – RFEEDERPH