Finding the right financial solution is something that we need at some point in our lives. This blog from Fastloans.ph will introduce the best loan app available for Filipinos.

Introduction

Finding online lenders in the Philippines is quite a task because of the many available options and terms. That’s why it’s important to know where to look for and which ones would offer you the best money lending application in the country.

This blog will cut through the noise and offer you the information you need to know to find the best loan app Philippines today.

Best Loan App Philippines For You

Digido Loan App

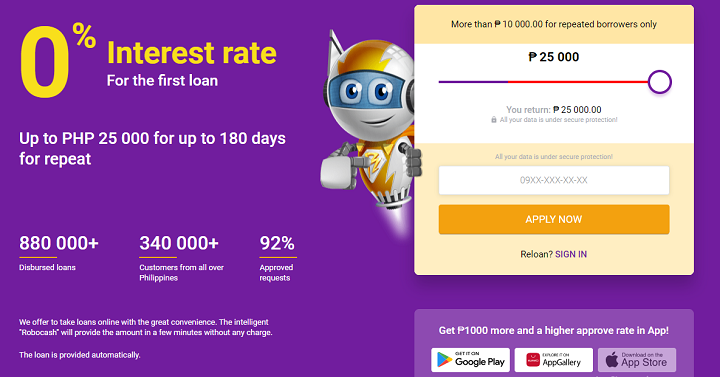

Digido is an instant personal lending app that gives out convenient loans with fair interest rates, providing you with a smarter way to handle your financial needs.

Digido offers unusual flexibility by allowing you to choose payment terms that fit your needs. This makes it easy to fit your payment into your budget.

With Digido, clients can:

- Borrow money from 1,000 – 25,000 PHP

- Enjoy 0% interest on the first time borrowing money and 11.9% when you borrow money for the next time

- Choose your desired payment term, from 3 to 6 months

- No need to mortgage property

Tala

Tala is an online service provider specializing in servicing consumers looking for fast and easy access to loan finance.

The company’s main focus is to provide fast applications, short-term loans, or cash advances with no collateral requirements. They aim to alleviate the cumbersome processes involved whenever one transaction with other money providers.

With Tala, clients can:

- Borrow up to 15,000 PHP with attractive interest rate

- From the second time, the loanable amount will be increased.

- Repay whenever you want, depending on your chosen payment term

MoneyCat

MoneyCat is an online platform specifically designed for Filipinos to access fast loans. Not only does it provide instant approval for your application, but it also allows you to pay back your debt through installment plans that you can afford. It is a great solution to all your financial problems.

With MoneyCat, customers can:

- Borrow up to 20,000 PHP for free (repay within seven days)

- Enjoy a reasonable interest rate at 11.9% per month for the next time

- Choose your desired payment term from 3 to 6 months

- No need to provide income proof

Online Loans Pilipinas

Online Loans Pilipinas originated from the need to cater the processing of a flexible and fast loan to all applicants who need financial assistance for any reason and especially to all those who cannot avail a loan from the banks and lending institutions.

OLP does not require you to submit your credit report, nor do they need any collateral. All they need is to know your basic information, such as your name, birthday, and email address. The rest will be processed quickly, and the application will forward the details directly to your email address.

With OLP, borrowers can:

- Enjoy a 0% interest rate at the first time borrowing (up to 7,000 PHP if you pay off within ten days)

- Repeated borrowers can borrow up to 20,000 PHP (or 25,000 PHP for valued customers) with a competitive interest rate (maximum 200% per year).

Pera247

Pera247 is a financial service that helps Filipinos get fast loans from their smartphone or computer. You can easily apply for their products without going to the bank with just a few clicks.

The best thing about Pera247 is that they offer loans with no credit checks and no collateral needed. It means that you can apply for a loan with Pera247 even if you have problems with your credit history.

With Pera247, clients can:

- Get 3,000 PHP on your first loan within 24 hours

- No hidden fees, no commission

- No need to provide income proof, credit history, collateral

Cashalo

Cashalo is a mobile app for online peer-to-peer money lending. It is an innovative way to get an instant no-credit-check and one of the best ways to get money in an emergency.

Cashalo app offers loans in as fast as 45 minutes to anyone with a smartphone and a 5-star rating. They are working round the clock to change how Filipinos access credit.

With Cashalo, borrowers can:

- Borrow from 2,000 – 10,000 PHP with a competitive interest at 0.3% per day

- Can choose to pay every day, or in payment terms up to 90 days

- Repeated borrowers have a higher loanable amount

Online Lending Apps: Pros And Cons

Pros

Convenience

Nowadays, online money lending apps are becoming very popular since their speed and convenience are unbeatable. The circumstances in which people seek this type of financial solution are various, but the very concept of fast and easy money lending is the same for all.

You can find many lenders in just a short period. With the click of a button, you can access various financial products that you might need.

Hassle-free

They offer financial services and make the procedure of money lending approval and disbursal a lot easier and simpler, thanks to their advanced technology. You do not need to be physically present at the location to avail of the loan, and there is no paperwork involved, etc.

You’ll need to fill out a short application and wait for the money in your account, and that’s why they are gaining popularity.

Cons

High-interest rates and hidden fees

Since the lending process is easier and faster, the interest is usually more expensive. It is an unavoidable fact because the debts are unsecured, and you’ll often need to pay high interest.

The more money you borrow, the higher the interest you’ll pay. On top of that, these financial products usually have several hidden fees. The application fees vary from lender to lender, and some might even be charged additional fees for late repayment.

High risk at exposing personal data

You have to fill out your personal information on the application to borrow that amount you need. As you can imagine, there is a risk of identity theft, illegally exposing your personal data, and even fraud when you provide all the information.

It will lead to a series of serious consequences in the future, such as being intimidated, threatened, and defamed, especially when you cannot repay your debt on time.

Conclusion

With so many options to choose from, it can be overwhelming to find the right financial solution for you, so Fastloans.ph wants to help you take advantage of them.

Once you have found your best loan app, please get in touch with the website to help you with the rest.

1 Comment

TESTIMONY OF HOW I GOT MY LOAN FROM A LEGIT LOAN LENDER, hello everyone my name is Evelyn Reckova, from Buckingham, United Kingdom an entrepreneur/ businesswoman. I Am here to testify how I got my loan from Mrs. Maria. after I applied several times from various loan lenders who promised to help but they never gave me the loan. Until a friend of mine introduced me to Mrs. Maria. she promised to help me and indeed she did as she promised without any form of delay. I never thought there are still reliable loan lenders until I met Mrs. Maria, who indeed helped me with the loan and changed my belief. I don’t know if you are in any way in need of a genuine and urgent loan, be free kindly write to us Whatsapp number:+60-11-6943-0341 please am a refer who getting my loan from her company.