As the country enters a new period with now lightened restrictions, many have become hopeful,with a more positive outlook for this year. As key players for economic recovery, this shift also enables micro-, small-, and medium-sized enterprises (MSMEs) to find new opportunities that can help them overcome challenges and grow their business.

Knowing that more people are now more inclined to do digital purchases, GCash, the country’s leading mobile wallet, now offers GCash Pro, a digital business solution that helps small entrepreneurs future-proof and expand their business. “We need to be aware of the challenges faced by these entrepreneurs and strengthen our position as a business partner for growth, beyond payments,” GCash president and chief executive officer Martha Sazon said.

GCash continues to enable business owners to provide seamless service to their customers and also track sales and increase their wallet limit, among others.

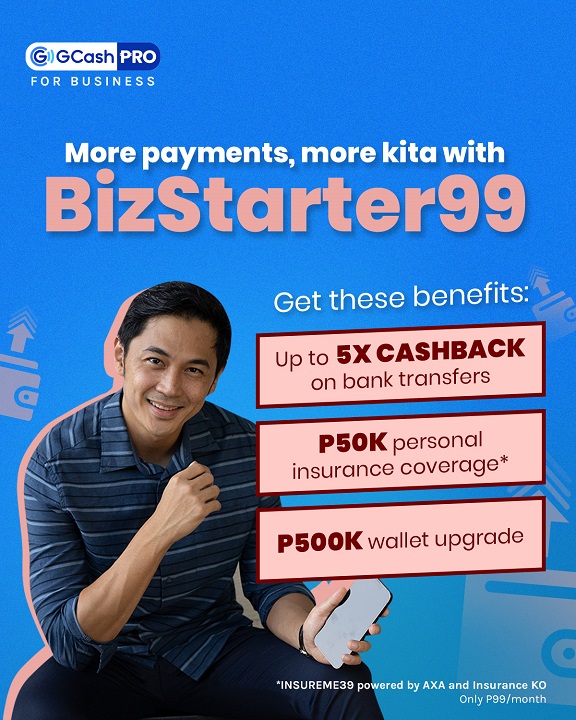

For as low as P99, business owners can avail of BizStarter99 which is a monthly subscription-based offer that will let them upgrade their business operations. Business owners will no longer have to worry about reaching their wallet limit in accepting payments. With BizStarter99, they can accept more payments from customers with an upgraded wallet limit of P500k. Apart from this, the subscription also helps them in managing their revenues and expenses as entrepreneurs are given up to 5X cashback on bank transfers, giving them up to P75 savings monthly. They also get free personal insurance coverage up to P50,000 — ensuring that they have proper assistance in times of need. All business owners have to do is to head over to www.gcash.com/promos/gcashprobizstarter99, click apply, and fill up the form. Applicants just need to make sure that their GCash account has P99.

Another service that GCash PRO provides for MSMEs is Payment Links which is a platform that lets business owners do real-time tracking and safely move their funds from receiving payments, to processing refunds, to making withdrawals — all through a dashboard. Likewise, Payment Links also gives their customers a convenient and seamless way of paying as they receive the links via messaging apps. They can easily pay the exact amount. The transaction is safe and secure as payments are only released to the merchant once the customer receives their goods. Business owners can sign up to payment links by registering through www.getpaid.gcash.com. Once verified via email, they can already start generating payment links.

“After reaching acquisition targets, launching new products and growing our presence in the MSME community, it’s imperative to sustain this momentum and leap forward to more growth opportunities,” Sazon said.

At end-December last year, GCash had 55 million registered users, more than double the 20 million users it had in January 2020. It also recorded 17 million peak daily transactions last year, up from only 6 million daily transactions in 2020. Along with this, GCash also currently caters to about 4.5 million merchants and social sellers who benefit from using GCash for their business needs.