UBX, the leading Open Finance Platform in the Philippines, has tapped global top insurance company PGA Sompo Insurance Corp. (PGA Sompo) to beef up its customer protection mechanism through personal cyber insurance.

UBX will serve as the principal policyholder for its end-users who are covered by the group insurance. Customers are guaranteed financial protection against electronic fund transfer fraud, identity theft, online retail fraud, purchase protection, and other cybersecurity-related threats.

This serves as an additional safety measure on top of the existing safety and security layers that UBX has deployed for its customers.

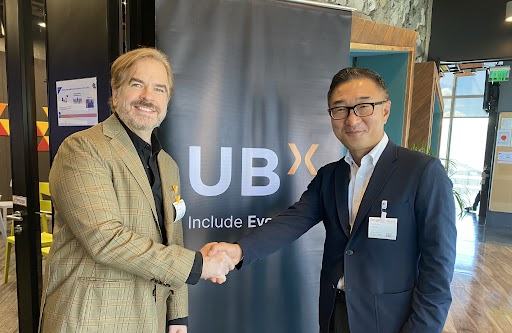

“While the use of technology in finance has grown exponentially these past few years, threats to security have increased as well. The trust and confidence of our clients are two of our most prized assets and we are committed to ensuring the safety of our users, most especially their financial security. Together with PGA Sompo, we can confidently give them peace of mind in using our open finance platform,” UBX President and CEO John Januszczak said.

This cyber insurance covers all end users of UBX platforms such as i2i, the banking-as-a-service platform of UBX; BUx, an end-to-end payment solutions platform; and Sentro, an online shop builder.

Among the top barriers that hinder users and merchants alike from digital adoption is security. For Philippine digital users, failed deliveries, incomplete deliveries, damaged products, and fraudulent transactions are usual experiences when transacting online. On the other hand, financial institutions usually go through down times as well when unexpected glitches occur which lead to paralysis of operations.

A big part of providing services requires an understanding of customer perspective and in the age of information, data is an important currency. Since it approaches customer experience from an empathic perspective, UBX makes it a point to meet present demands by prioritizing data security, which is the primary concern of both corporations and individuals.

“More than just giving them the technology to enhance their operations, we want to make sure that businesses, organizations, and financial institutions are protected from external threats as they undertake their journey towards digital transformation,” Marc Gorospe, Business Lead for Insurtech at UBX, explained.

Gorospe added that it is high time to add to the layers of security across all UBX platforms as the number of its clients and customers continue to grow, cementing its position as the preferred open finance platform in the Philippines.

The Bangko Sentral ng Pilipinas has recently mandated banks and financial institutions to strengthen their policies on customer confidentiality and security. Now more than ever, major players in finance are required to double their efforts in achieving this goal.

“As advocates of financial inclusion, we are always on the lookout for like-minded individuals and institutions who are just as committed to putting the trust and confidence of their clients and customers above anything else to guarantee an equal and level playing field for all,” said Januszczak.