SCG reported its operating results for Q1/2023, showing a recovery across all business units, with increased sales and profits boosted by the revival of tourism and China’s border reopening. SCG is also accelerating its focus on SCG Cleanergy, an end-to-end clean energy business that continuously grows in response to global trends in environmental protection propelling SCG towards long-term growth. Similarly, SCG observed successful cost reduction through the increased use of alternative fuels and solar energy. To further boost its ESG efforts, SCG commenced trial operations of its petrochemical complex project, Long Son Petrochemicals (LSP), producing plastic resins to supply the Vietnamese market.

“SCG’s Q1/2023 operating results showed revenue of PHP 208,431 Million (US$ 3,797 Million), an increase of 5%Q-O-Q, and a profit of PHP 26,754 Million (US$ 487 Million), including the one-time gain from fair value adjustment of investment in SCG Logistics, following SCGJWD Logistics merger transaction in Cement-Building Materials business amounting to 19,356 Million PHP (US$ 353 Million). Meanwhile, Profit excluding extra items would have been PHP 7,311 Million (US$ 133 Million), which increased PHP 5,579 Million Q-O-Q, due to higher chemicals spread and sales volume, as well as lower energy cost.” Roongrote Rangsiyopash, President and CEO of SCG disclosed.

Profit excluding extra items amounted to PHP 7,311 Million (US$ 133 Million). This is an improvement from the previous quarter, with an increase of PHP 5,579 Million driven by increased sales in all business units, higher chemicals spread, the recovery of the construction market, and booming tourism have led to higher demand for cement, building materials, and packaging in Thailand, coupled with falling coal prices and reduced costs through greater use of alternative fuels and solar energy in business operations.

Compared to the same period of the previous year, Revenue from Sales fell by 16%, mainly from Chemicals Business. Meanwhile, Profit excluding extra items decreased by 42% y-o-y, largely attributable to lower sales volume and equity income in Chemicals Business, as well as higher energy cost compared to the previous year.

In Q1/2023, SCG’s Revenue from Sales of High Value Added Products and Services (HVA)reached 65,562 Million PHP (US$ 1,203 Million), accounting for 33% of total Revenue from Sales. SCG’s Revenue from operation outside Thailand, including export sales from Thailand, registered was PHP 83,099 Million (US$ 1,525 Million) in in Q1/2023 or 42% of total Revenue from Sales.

Environment Sustainability Efforts

With the global trend towards environmental conservation and high electricity prices, SCG Cleanergy has been growing continuously and well-received. The Smart Grid technology for buying and selling clean energy electricity is convenient and fast, and it also enables customers to sell their clean energy electricity in the future. SCG was selected to produce and sell solar power to the government in 10 projects, with a total capacity of 367 megawatts, equivalent to the average electricity consumption of 180,000 households. At the same time, investing in Rondo Energy which develops the world’s highest temperature thermal energy storage battery innovation helps reduce the combustion of fossil fuels and lower carbon dioxide emissions.

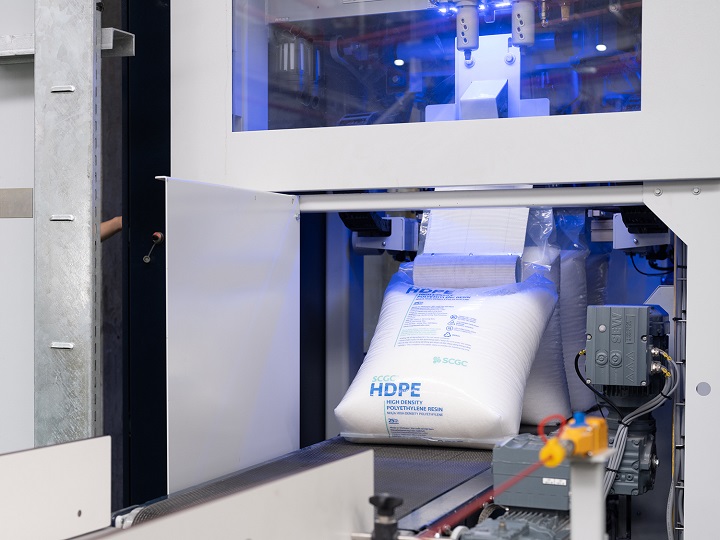

The LSP petrochemical complex project has a strong advantage in cost management, thanks to its feedstock flexibility that allows it to align with market conditions. SCG will commence LSP’s commercial operations by the middle of this year. To add, the business is moving forward with SCGC GREEN POLYMERTM which will continue to grow this year following last year’s sales volume of 140,000 tons.

SCGC collaborated with global business partners such as Colgate-Palmolive (Thailand) to develop Lightweight packaging made from High Quality Post-Consumer Recycled Resin (PCR) for Care and Protex powder products using SMX™ technology. The packaging output is 20% stronger than conventional plastics but reduces packaging weight by up to 8%, helping to reduce greenhouse gas emissions. SCG also worked with SACMI to design eco-friendly bottle caps for carbonated beverages with tethered caps to help reduce litter and make recycling more efficient.

SCG Chemicals and Cement Business

Chemicals Business is well-prepared and able to effectively adapt to market conditions. The Rayong Olefins (ROC) plant has accelerated resuming production since the beginning of February 2023 due to rising regional demand following China’s reopening, signifying a progressively positive trend. Furthermore, SCG Decor has announced a merging plan with COTTO to expand and grow as an ASEAN leader in integrated decor surfaces and bathroom business, with a focus on innovation, design, and environmental friendliness.

The performance of the Cement-Building Materials Business improved due to the gradual economic recovery and cost reduction by increasing the use of alternative fuels, from 34% last year to 38%, and increasing the use of solar energy from 177 megawatts last year to 179 megawatts in Q1/2023.

As green innovations have gained ground, the use of ‘SCG Hybrid Structural Cement’ to help mitigate global warming increased by 50%, helping to reduce carbon dioxide emissions in the production process by more than 80,000 tons in Q1, equivalent to planting 8 million trees. The product offers robustness and aesthetics, and it has been used in several projects adhering to green building standards, such as the ONE BANGKOK project and the Supalai Loft Ratchada-Wongsawang project. As summer approaches and electricity costs rise, the ‘SCG Solar Roof Solutions’ business grew by 313% y-o-y, and the ‘SCG Air Scrubber’ innovation for large buildings has been accelerated, helping to save 20-30% of energy and reduce greenhouse gas emissions such as carbon dioxide.

SCG in ASEAN (ex-Thailand)

Regarding the ASEAN market, recovery appears to need more time. High interest rates and inflation rate continue to impact the real estate sector in some countries. Meanwhile, the global economy remains fragile, particularly in the United States and Europe, with risks of an economic slowdown due to the inflation crisis, high interest rates, and fluctuations in energy prices.

For SCG’s operation in ASEAN (ex-Thailand), the Revenue from Sales in Q1/2023 recorded a 20% decrease Y-O-Y, amounting to PHP 35,860 Million (US$ 653 Million), and 17% of SCG’s total Revenue from Sales. This includes sales from both local operations in each ASEAN market and imports from the Thai operations.

As of March 31, 2023, the total assets of SCG amounted to PHP 1,473,716 Million (US$ 27,093 million), while the total assets of SCG in ASEAN (ex-Thailand) were PHP 657,055 Million (US$ 12,079 million), 45% of SCG’s total consolidated assets. The company reported Q1/2023 Revenue from Sales at PHP 3,814 Million (US$ 69 Million), a decrease of 26% y-o-y mainly from the Chemicals business and lower export from Thailand.

“In fulfilling commitments to ESG 4 Plus goals, SCG provides opportunities for SCG Sharing the Dream university students to experience sustainable manufacturing processes at Vina Kraft Paper and Prime – Vinh Phuc JSC. This aims to foster sustainable mindsets among young people, enabling them to become responsible citizens who prioritize long-term sustainability.” Roongrote concluded.

As a recognition for relentless contributions to the country’s sustainable development, SCG was among the Top 50 exceptional Foreign Invested Enterprises (FIEs) in Vietnam and honored as a Pioneer in ESG Practices at the 2023 Golden Dragon Awards.