While Bangkok remains the most visited destination in Asia Pacific, Singapore continues to lead the Thai capital in total visitor expenditure, according to the latest findings from the Mastercard Asia Pacific Destinations Index 2017 shared at the World Travel & Tourism Council (WTTC) Global Summit in Bangkok.

Over the past two years (2015-2016), Singapore has tracked a strong 18.0 percent leap in visitor spend. One of only five destinations of the top 20 by total expenditure to reach a minimum spend of US$200 per day, Singapore attracted the highest spending visitors at US$254 per day, followed by Beijing (US$242), Shanghai (US$234), Hong Kong (US$211) and Taipei (US$208).

According to the Index’s findings, 2016 was an exciting year for tourism in Asia Pacific. Fueled by increasing consumer wealth amongst Asia Pacific’s emerging markets, the region’s thriving tourism industry continues to show vigorous progress. It is the world’s fastest growing region for international tourism by GDP contribution, with tourism making up 8.5 percent of Asia Pacific’s GDP and 8.7 percent of total employment last year.

Overnight arrivals make an unprecedented jump

Half of the top 20 most visited destinations in Asia Pacific saw more than 10 percent growth in international overnight arrivals from 2015 to 2016. Destinations that benefitted most from this growth include Northeast Asian and Southeast Asian markets – Seoul (32.7 percent), Osaka (23.8 percent), Bali (22.5 percent), Tokyo (22.2 percent), Hokkaido (21.9 percent), Chiba (21.5 percent) and Pattaya (20.6 percent).

This growth provides significant opportunities which governments, tourism bodies, and merchants can benefit from, including greater economic, cultural and infrastructural development. To ensure sustainable growth, public and private sectors are working to create more welcoming spaces for visitors and residents alike – as well as more seamless ways to get around destinations.

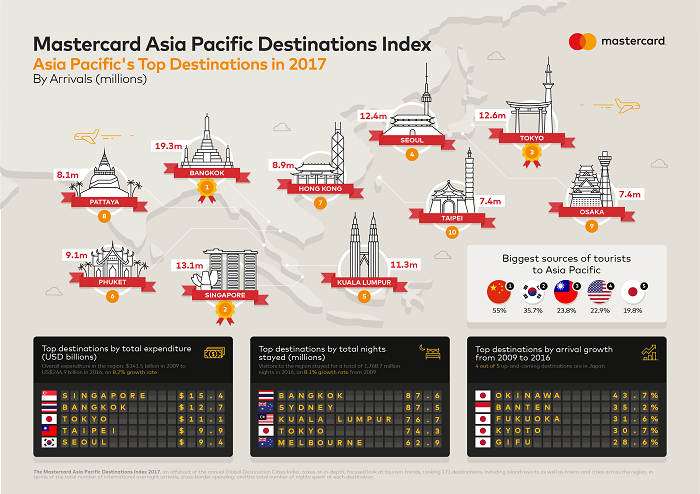

Overall, overnight arrivals to the 171 Asia Pacific destinations in 2016 stood at 339.2 million (9.8 percent CAGR from 2009-2016), led by Bangkok which tracked 19.3 million visitors. Singapore (13.1 million) came in second place, followed by Tokyo (12.6 million), Seoul (12.4 million) and Kuala Lumpur (11.3 million). China stands as Asia Pacific’s most avid outbound travel market, having contributed 55 million international overnight visitors to the region last year or 16.2 percent of the total.

Total nights stayed hit new highs

Visitors to Asia Pacific destinations are traveling to the region more, and doing so for longer periods. In 2016, visitors to the region stayed for a total of 1,768.7 million nights, an 8.1 percent CAGR from 1,023.1 million nights in 2009. Bangkok took the lead with 87.6 million nights, while Sydney came in second place with 87.5 million, followed by Kuala Lumpur at 76.7 million.

In particular, Sydney’s second-place position is especially outstanding compared to its number of overnight arrivals. Taking 20th place in the latter ranking, Sydney’s ratio of average number nights stayed versus number of overnight arrivals is shared by fellow Australian destinations Melbourne and Brisbane on the Index. As many tourists have to travel a distance to reach Australia, they are more likely to stay for longer periods to make their journey worthwhile.

Overall visitor spend leaps almost twofold

Spurred by Asia Pacific’s burgeoning middle class, overall tourism expenditure in the region jumped from US$141.5 billion in 2009 to US$244.9 billion in 2016, an 8.2 percent CAGR Moreover, Asia Pacific’s top 20 source markets contributed US$201.5 billion to the region’s tourism revenues in 2016.

The mass of tourists from Northeast Asia have helped to boost these earnings. Key findings from the Index revealed China (17.7 percent) and South Korea (8.8 percent) as the largest contributors to tourism expenditure in Asia Pacific. In fact, these two markets were also top source markets for Singapore (China #1), Bangkok (China #1) and Tokyo (Korea #1, China #2), the region’s leading destinations by visitor expenditure. As renowned global shopping and dining locales, they are popular amongst affluent Chinese and South Korean tourists seeking new shopping or culinary experiences.

Part of Mastercard’s commitment to supporting the region’s tourism industry, the Asia Pacific Destinations Index analyzes travel journeys across 171 Asia Pacific destinations to help the travel industry, government and stakeholders better understand and cater to tourism demand.